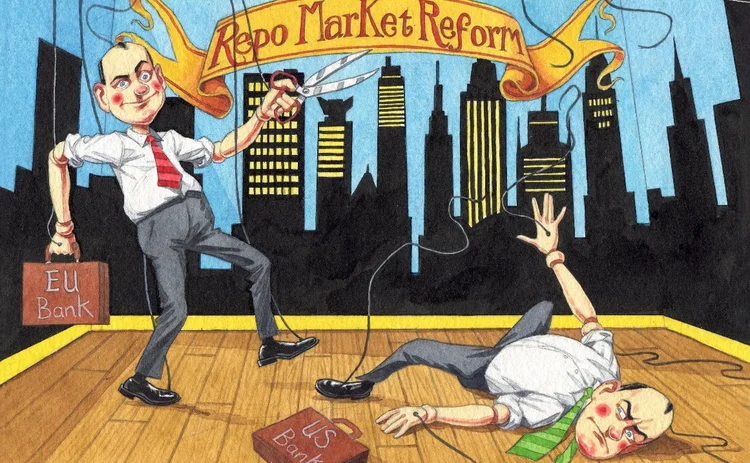

L’exception française: why French banks dominate US repo trading

French banks are exploiting a quirk in the leverage ratio rules to expand repo trading

Need to know

- A difference in the way French banks measure their leverage ratio exposures has allowed these firms to expand their US repo balance sheets, even as US banks contract theirs.

- Excluding the Federal Reserve, the top three US Treasury repo counterparties to money market funds (MMFs) are French banks.

- BNP Paribas traded $38.1 billion in US Treasury repos with MMFs in July – more than its four largest US competitors combined. Societe Generale and Crédit Agricole have also expanded their US Treasury repo operations.

- The rise of foreign dealers worries some repo market participants. "Market participants need to be cognisant of their counterparty creditworthiness at all times," says Jerome Schneider, a managing director at Pimco.

- US tri-party repo reforms have spurred more firms to trade bilaterally.

- Some dealers are proposing new ways to trade repo on an agency basis, but MMFs are treading carefully.

Natixis is not the first name that springs to mind when people think of a big Wall Street repo dealer. Yet the French bank traded $10 billion in US Treasury repos with money market funds (MMFs) in July – more than domestic heavyweights such as Bank of America, Citi, Goldman Sachs and JP Morgan.

Natixis is one of several European banks that are taking advantage of regional differences in the way the leverage ratio is applied to expand their US repo books.

"As the balance sheet that was supplied by traditional players has been pulled back and in turn pushed spreads wider, there has been a greater demand from counterparties to broaden their sources of funding," says John Kolb, managing director, treasurer for the Americas, at Natixis in New York.

We made a decision to expand our repo book in the US and globally, so that's why you see a larger use of our balance sheet, along with our other French compatriots

A senior executive at one of the three French banks

The three big French banks – BNP Paribas, Crédit Agricole and Societe Generale – have more than doubled their share of US Treasury repo trades with MMFs since the start of 2013, and now rank as the top counterparties to this segment of cash lenders (see figure below). BNP Paribas alone booked $38.1 billion of US Treasury repos with MMFs in July – more than the four largest US banks combined. Crédit Agricole and Societe Generale are close behind, with positions totalling $33.5 billion and $32.4 billion respectively at the end of July, according to data from the US Treasury's Office of Financial Research (OFR).

"We made a decision to expand our repo book in the US and globally, so that's why you see a larger use of our balance sheet, along with our other French compatriots," says a senior executive at one of the three French banks. "As a result of the supplementary leverage ratio, spreads have widened out, and if you have balance sheet then you're able to take advantage of that over the US banks that have reduced their balance sheets."

Click here to enlarge, or tap image on app

The trend is not limited to the French. Some Canadian and Japanese banks that recently started trading US Treasury repos with MMFs are seeing astronomical growth. Nomura's volumes jumped from $100 million in January to $7 billion in July, while Royal Bank of Canada's repo book grew to $15.5 billion in June from $1.2 billion a year ago.

The rise of foreign banks is the most visible manifestation of the regulatory changes reshaping the US repo market, where nearly $4 trillion in cash changes hands each day. For broker/dealers, hedge funds and other financial firms, repos are a source of instant liquidity, allowing them to borrow cash to fund their operations using securities as collateral. MMFs are the primary source of this cash. Banks mediate, building up vast books of offsetting trades, and also use the market to meet their own short-term funding needs.

Matched-book repo trading is a low-margin, balance sheet-intensive business, however – meaning it was one of the first areas to be cut when the US supplementary leverage ratio (SLR) was introduced in September 2014. European banks, which operate under less stringent leverage rules, have filled the void, emerging as the dominant players in the US short-term funding markets. Of the top 10 US Treasury repo dealers as of July 31, nine were European, the OFR data shows.

Market participants need to be cognisant of their counterparty creditworthiness at all times

Jerome Schneider, Pimco

At the same time, new MMF reforms in the US are diverting cash from funds investing in commercial paper to those that primarily lend against government securities. The influx of foreign banks has provided a much-needed boost to these government MMFs, which were facing a rapidly shrinking pool of US dealers.

Still, not everyone views the proliferation of new dealers as a positive development. "Market participants need to be cognisant of their counterparty creditworthiness at all times," says Jerome Schneider, managing director, and head of the short-term and funding desk at Pimco in Newport Beach, California. "This has become more of a focus in the repo market, where there are a few emerging but lower-rated repo dealers. While it's good because it creates more liquidity, there should be pause to make sure the market is properly underwriting the counterparty risk and determining if they have enough capital to weather times of stress."

These concerns have been exacerbated by recent disruptions to the tri-party repo market – where a clearing bank takes custody of collateral and settles trades on its books – which are spurring more firms to trade bilaterally (see box: Three's a crowd?).

Jerome Powell

Jerome Powell

Regulators are mindful of the market's increasing reliance on foreign dealers and bilateral repos, but offer no short-term fixes. "The leverage ratio, the liquidity coverage ratio, tri-party repo reform, MMF reform – these are some of the central pillars of post-crisis reform that address major problems in the financial system," says Jerome Powell, a governor of the US Federal Reserve. "I don't sense any appetite for adjusting these reforms, at least until we give markets a significant amount of time to adapt to them."

This is little consolation to US banks, to whom the rapid ascent of European dealers smacks of regulatory arbitrage. Under rules adopted by the European Commission on October 10, 2014, European banks are required to measure and report their leverage exposures at the end of the quarter, while US banks must calculate their exposures on a daily basis. The Bank of England passed additional rules in December 2015, requiring UK banks to calculate the exposure measure based on firms' daily on-balance-sheet assets, averaged over the quarter. French banks, meanwhile, are free to run vast overnight repo books until quarter-end, when they allow the positions to roll off, dramatically shrinking their balance sheets. Once quarter-end has come and gone, they get back to business as usual and their leverage spikes up again.

This strategy has allowed French banks to feast on rising repo spreads – the difference in the rates at which banks borrow and lend cash – which were as high as 60 basis points in June.

Even at those levels, US banks cannot turn a profit. "If you're going to devote balance sheet to meet MMF demand, you're going to have to [have] a very attractive return on assets," says the head of the finance desk at a large US bank in New York. "You'd need to earn 200bp on the balance sheet, and in the repo business margins average around 10–20bp."

Click here to enlarge, or tap image on app

The influx of foreign dealers has relieved some of the pressure on government MMFs, which are bracing for huge inflows. The Securities and Exchange Commission's (SEC) money market fund reforms, which take effect on October 14, require prime MMFs investing in commercial paper and floating rate debt to establish gates and fees to stem outflows during periods of financial stress. This is driving investors into government MMFs, which are more reliant on repo markets.

The willingness of European dealers to expand their repo balance sheets has given government money funds a shot in the arm. "We've been getting a lot more traction with dealers and we're getting a lot more repo done," says Marques Mercier, a senior portfolio manager at Invesco in Atlanta. "You can see that trend with the Fed's reverse repo programme (RRP), where the numbers are much lower now, compared to previous years. That's because there is excess repo supply in the market at the moment."

The Fed's RRP – where MMFs earn 25bp on overnight loans collateralised with US Treasuries – has been the go-to investment option for MMFs since it launched in September 2013, with monthly volumes peaking at $424 billion in December 2015 (see figure below). This dropped to $85 billion in July, as foreign banks took on more business. It is good news for MMFs, which typically earn 2–5bp over the Fed's RRP rate of 25bp when they lend to dealers.

Click here to enlarge, or tap image on app

Still, transacting with European dealers comes with a few health warnings. First, MMFs must be prepared for the quarter-end phenomenon when European balance sheets shrivel dramatically.

"The informal agreements we have with our banks are usually good until we get to quarter-end, where the banks are right-sizing their balance sheets for those statement periods. It's not unusual for them to cut back on the amount of repo they are making available to us, which can be as much as 80%. As they are doing that, we are looking to other counterparties, such as the Fed," says Joseph Lynagh, a portfolio manager in the fixed-income division and head of the cash management team at T. Rowe Price in Baltimore.

Second, some big European dealers prefer to transact bilaterally, rather than via tri-party clearing banks, which are generally considered to be the safest counterparties on the Street. "One of the trends we have definitely seen is an increase in bilateral trades," says Invesco's Mercier. "We have a substantial amount of bilateral overnight trades with our traditional repo counterparties." Bilateral trades now account for around half of Invesco's repo volumes – a big change for a firm that did all its repo business on a tri-party basis until 2015.

Shift from tri-party repo

The shift away from tri-party repo can be traced back to changes implemented at the behest of the Tri-Party Repo Infrastructure Reform Task Force, formed in 2009, at the request of the New York Fed. The body was charged with eliminating the need for the clearing banks to extend large amounts of intraday credit to dealers active in the tri-party repo market. Before the crisis, the clearing banks would routinely underwrite more than $100 billion of credit exposure to a single dealer each trading day, according to the Fed.

In February 2012, the task force released a seven-point plan to fix the problem, including capping the amount of credit provided by clearing banks to 10% of a dealer's notional tri-party book. Dealers say the 10% cap, coupled with charges of up to $1,000 per billion notional per hour for using a clearing bank's credit facility, has made tri-party repo less appealing.

"Tri-party repo costs have become prohibitive for certain banks," says Ernest Mammano, a director at Natixis in New York. "In the past, when you did a tri-party trade, as long as the cash stayed at the clearing bank all day with the same counterparty, you didn't get charged. But once the daylight overdraft and credit fees came in May 2014, that's when it became an advantage to do bilateral. It appears more dealers and banks are moving in that direction."

The credit fees make it riskier for dealers to trade with certain clients in the tri-party market, according to the New York-based head of repo at a European bank. "If a tri-party client lends me $1 billion every day and they take mortgage-backed securities (MBS) as collateral, that money never really moves, so I don't have a problem as far as the daylight overdraft charge is concerned," he says.

"But if the client decides to shift $500 million from MBS to US Treasuries, the $500 million will come out of tri-party. When the US Treasuries are delivered [in another trade], which could be as early as 8.30am or 9am, we need to pay for them, which will cause a potential daylight overdraft issue if the bank doesn't have the cash on hand as the new tri-party cash may not arrive until 5pm," he adds.

MMFs' mixed feelings

The shift to bilateral trading arouses mixed feelings among MMFs. Some have embraced the change. "Bilateral repo makes a lot of sense for banks right now, because when we execute the trade first thing in the morning and agree the collateral, as soon as they make delivery of that collateral they get the cash," says Mercier. "So we can get those trades settled first thing in the morning, as opposed to waiting until the end of the day."

Others are more cautious. "One of our bank counterparties now does just bilateral repo," says Dave Fare, a portfolio manager at Western Asset Management in New York. "However, we do not do a lot of that, because it's a much more cumbersome way to do repo. You have to deliver the individual trades one by one, and it increases operational risks and costs too."

The phenomenon of foreign banks trading bilateral repos with MMFs could be short-lived, however. The party is poised to come to an end in 2018, when the US SLR will be applied to foreign banks with more than $50 billion in consolidated US assets under the Fed's enhanced prudential standards for foreign banking organisations (FBOs).

The Fed's prudential standards, published in February 2014, require FBOs with more than $50 billion in consolidated US assets to place all their US subsidiaries in an intermediate holding company (IHC), which will be held to the same capital, liquidity and risk management standards as US bank holding companies.

The Fed's prudential standards, published in February 2014, require FBOs with more than $50 billion in consolidated US assets to place all their US subsidiaries in an intermediate holding company (IHC), which will be held to the same capital, liquidity and risk management standards as US bank holding companies.

This could have a significant impact on the amount of balance sheet that foreign banks allocate to repo trading. "This is coming down the pipeline and we'll cross that bridge when we come to it," says the senior executive at the French bank. "Everyone is concerned by this, but we really need to keep the liquidity going, and in order to do that we will have to adapt the way we trade."

Dealers are already thinking ahead to 2018 and proposing new ways to connect MMFs with end-borrowers such as hedge funds on an agency basis.

"There are a number of different ideas that [have] been doing the rounds, whereby repo could take place outside the traditional construct of a bank acting as principal," says the New York-based head of US finance at a European bank. "One idea would be a bank acting as agent between a borrower and a lender, and the bank guaranteeing the performance of one of the counterparties."

I do have concerns that the repo funding market will dry up if we run into a crisis

A trader at a broker-dealer firm in New York

Such an approach would keep repo trades off the balance sheet and ensure they do not contribute towards the bank's leverage ratio exposure. "We would guarantee the cash leg for the MMF via a special contract, so that in the event of default, the MMF would have the option of taking collateral and selling it on their own or taking the cash back. Either way, they would have a guarantee of getting cash," says a senior trader at a large bank in New York, adding: "We would just guarantee one leg of the transaction, because if we guaranteed both legs, it would appear on our balance sheet."

MMFs are open to the idea, although Risk.net understands none have taken the plunge as yet.

"We have seen many proposals of this kind and there certainly seems to be an appetite on both sides as the balance sheet usage makes it unattractive for the banks right now. This would help eliminate costs," says a portfolio manager at an asset management firm in Philadelphia. "However, we are yet to see an opportunity that we have been willing to embrace."

In the absence of regulatory relief, most believe the repo market will ultimately shift to an agency model. "We're slowly walking down that path, but we have not found a structure that makes us feel comfortable from a credit standpoint," says Deborah Cunningham, chief investment officer at Federated Investors in Pittsburgh. "No doubt it might be something we could look at going forward."

For regulators, the preferred solution is to establish a comprehensive clearing framework that would allow banks to net their exposures to cash lenders and borrowers. "Central clearing [for repo] could both reduce balance sheet pressures and improve risk management without requiring exceptions from existing prudential regulations," says the Fed's Powell.

However, efforts to launch such a service have hit a series of roadblocks. LCH has abandoned its plans to launch a US repo clearing service, while the Depository Trust Clearing Corporation's proposed repo clearing service for the buy side has been held up by regulatory concerns.

The current state of affairs worries some smaller financial firms that rely on the repo market to fund their operations. "I do have concerns that the repo funding market will dry up if we run into a crisis," says a trader at a broker-dealer firm in New York. "September will be a good test before MMF reform kicks in and then I expect [the] year-end to potentially be a real mess. We need to fund our books somehow, and if we can't, we can't provide liquidity. In a crisis, that could be a real problem for the market."

Three's a crowd?

Harried by regulators to de-risk its business, JP Morgan announced on July 21 that it would stop settling cleared tri-party repo trades for dealers by the end of 2017, leaving Bank of New York Mellon as the sole clearing provider in a $1.6 trillion market – an outcome that worries some market participants.

"It's going to raise more systemic issues, considering BNY Mellon is going to be even more significant as the dominant tri-party custodian," says Peter Yi, director of short-duration fixed income at Northern Trust in Chicago. "Market participants will consider what that means to the marketplace, because if something happened from a credit perspective to BNY Mellon, trillions of dollars of settlement instruments could be at risk."

Regulators are considering the implications, too. "We have done a lot of thinking about how we would deal with a sole provider, and what our expectations will be for that business in terms of resiliency and liquidity," says Jerome Powell, a governor of the US Federal Reserve. "Our expectations will be very high for them, and BNY Mellon appears to understand and appreciate that."

The Fed wields a pretty big stick over BNY Mellon, which has been designated as a globally systemically important bank (G-Sib). The firm was assessed a G-Sib surcharge of 1.5% for 2016. One of the inputs for calculating the surcharge is substitutability – essentially the ease with which the services provided by one bank can be replaced by another. A bank's substitutability score can contribute up to 100 basis points to its G-Sib surcharge. Increasing BNY Mellon's score is one of the levers at the Fed's disposal. Such an outcome would be painful for the bank, considering the razor-thin margins on offer in tri-party repo clearing.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Hedge funds flock to hybrids to trade macro uncertainty

Firms repurpose structure made popular by Trump trades last year

EU debt wave raises dealer capacity concerns

Ongoing QT and upcoming defence spending piles pressure on bank balance sheet supply, say dealers

FX traders revel in March Madness

Chaotic Trump policies finally bring diversity to flows – to the delight of market-makers

Jacky Mak leaves HKEX to take career break

Industry veteran and Swap Connect pioneer announced resignation at weekend

Can Bessent lower 10-year yields? Investors have their doubts

Unconventional tools won’t sway bond markets, say buy-siders, with yields as likely to go higher as lower

J.P. Morgan Inverse VIX Futures ETN: a more intuitive approach to risk

J.P. Morgan’s new inverse Vix futures ETN, designed for a more stable risk profile

ALM desks await rebound after euro swap spread hit

Bank treasury desks still feeling pain on bond and asset swap positions that saw big losses last year

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market