Linear, yet attractive, Contour

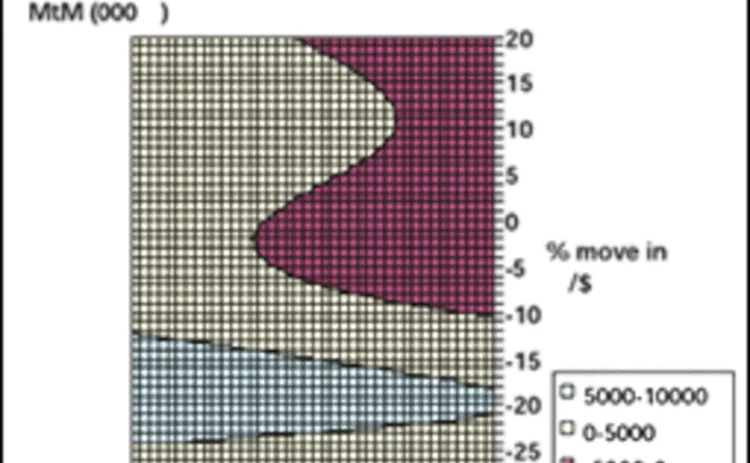

Banks’ Potential Future Exposure models are at the core of the advanced EAD (Exposure At Default) approach to capital requirements for credit risk considered in the New Basel Capital Accord. Juan Cárdenas , Emmanuel Fruchard and Jean-François Picron look at a method to quickly and accurately estimate Potential Future Exposure on portfolios of OTC derivatives dealt with a single counterparty with whom netting applies.

However netting

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Offshore bonds to give China lifers a yield lifeline

Expansion of Bond Connect scheme will provide higher yielding assets for life insurers, and may ease concerns over asset-liability management

Prop AMM makes CIO Jump to attention

Jump Trading’s Olsen says new tool allows users to create a ‘mini’ version of the firm

Morgan Stanley makes cuts to real money FX coverage

Departures from London-based team came as bank was reportedly shedding 2,500 jobs

Wheels in motion: AB fully automates forex trade execution

US fund manager claims to save time and money with hands-free trading

CDS financials index to relaunch – minus big bank names

Revamped index drops G-Sibs and adds BDCs, but questions remain around use cases

Iran conflict squeezes hedge funds’ short inflation bets

Rising gas and oil prices have sent headline inflation soaring with some funds being stopped out

Could prediction markets go wholesale? Exchanges think so

Some venues are exploring demand for institution-focused product; others say wholesale users can play in retail space

‘A new model’: Marex’s plan to take on the big banks

Non-bank challenger stepping into new businesses and new markets as incumbents retrench