CFTC facing struggle to revive commodity position limits

US federal commodity position limits were defeated in court in September, but the Commodity Futures Trading Commission has not thrown in the towel. In a two-pronged attack, the agency is expected to appeal against the ruling and is also thought to be working on a new version of its regulation – but it faces some big obstacles. Peter Madigan reports

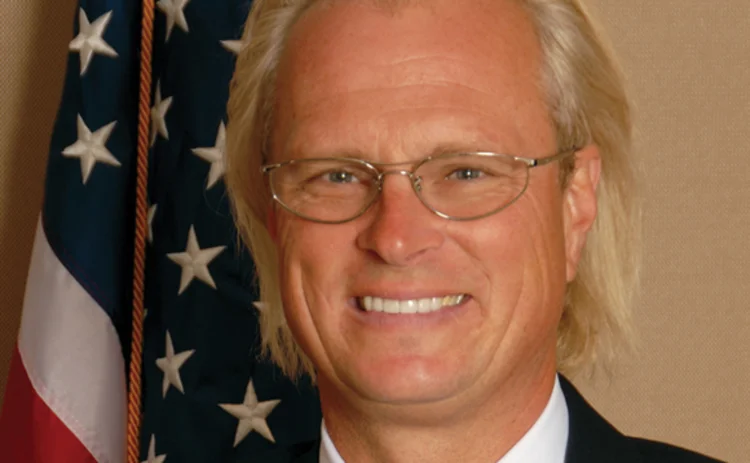

The Commodity Futures Trading Commission (CFTC) is not giving up on its position limits rule, struck down on September 28 – just a fortnight before it was due to take effect – when a US court decided the agency had overstepped the authority given to it by the Dodd-Frank Act. According to the CFTC’s chairman, Gary Gensler, the regulator is considering appealing against the judgement and could also write a new version of the rule – which is designed to prevent speculation in 28 physically settled

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Commodities

Energy Risk Commodity Rankings 2025: political upheaval adds to commodity market risk

The 2025 Commodity Rankings reveal the brokers and dealers that market players turn to in challenging times

Energy Risk Software Rankings 2025: market upheaval puts emphasis on IT systems

Quality of risk management key to performance in today’s volatile markets

Corporates keep the faith on net-zero goal

Large corporates’ energy transition includes trading and risk management in energy and commodities markets

Energy Risk Asia Awards 2024: The winners

Winning firms adapt to change with exemplary risk management skills

Foreign funds are bulls in China’s onshore commodity futures

Growing participation from overseas investors is boosting liquidity in what’s already a boom market

Energy Risk Software Rankings 2024: IT demands increase amid rising risk

Heightened geopolitical and credit risk increase requirements on commodities software

Energy Risk Asia Awards 2023: The winners

Winning firms demonstrate resilience and robust risk management amid testing times

ION Commodities: addressing the market’s recent pain points

Energy Risk Software Rankings winner’s interview: ION Commodities