Power surge: the evolution of PPAs

In the first of a series analysing the financial risks of renewable energy, Cyriel de Jong looks at key developments in the power purchase agreements market

Global efforts to transition to a low carbon economy depend hugely on what can be achieved in the electricity sector. Approximately 72% of global CO2 emissions are emitted through the production of energy, and 31% directly from the production of electricity and heat.

Switching from coal to gas is an important part of the greening strategy, as is replacing fossil fuel generation with renewables. Additionally, the transition calls for the electricity sector to expand, with electricity replacing the use of fossil fuels for transport, heating and many industrial processes. Altogether this will require a huge increase in the use of renewables. According to the International Renewable Energy Agency, almost $22.5 trillion of investment in renewable installed capacity is required in the run-up to 2050 to achieve global energy transformation goals. This implies a doubling of annual investments from current levels to more than $660 billion.

Of course, the impact of the Covid-19 pandemic on the climate change agenda remains to be seen. While low oil prices don’t incentivise a switch into renewables, the pandemic has given governments an unwelcome insight into how a global crisis can derail economies. Many believe this will focus minds even more on trying to avoid the extremes of climate change.

However, while the political and ethical incentive to develop renewables has never been higher, neither have the financial risks.

When renewable electricity was nascent, many governments provided direct support, for example through investment subsidies and feed-in tariffs (FITs). Globally, FITs have been the most popular government policy to support renewable energy projects. The schemes guarantee a fixed income for each megawatt hour (MWh) of energy produced over a period of 10 to 15 years. But FIT levels have decreased over time, as the renewable industry has matured and the technology costs have fallen. Nowadays, most governments are still willing to socialise the network costs, and subsidise specific innovative technologies, but the bulk of renewable electricity will have to compete in the market. With renewable power investments needing to pay for themselves, stringent analysis of the financial risks of such projects has become critical.

This series of articles looks at the major financial risks and the tools for managing them. These are quite different from other commodity markets. For example, long-term price risks depends more than any other market on government policies and technological progress, requiring fundamental power market scenarios. Also, the growth of renewable capacities leads to an increasing price cannibalisation effect – the more renewables in operation, the lower the electricity price becomes – and this has to be factored in. Finally, the combination of price and volume risk requires different optimisation tools and hedging strategies.

Central to managing the complex and long-term risks of renewables projects are power purchase agreements (PPAs) – bilateral contracts between buyers and sellers of electricity. The term PPA generally refers to somewhat structured and often longer-term contracts – sometimes spanning even more than 20 years – as opposed to standard electricity forwards and futures. The purpose of the PPA is to distribute the financial risks and rewards between asset owners and electricity buyers. Directly or indirectly, the other financial players, such as infrastructure lenders, are also affected by the contents of the PPA. For example, banks are more willing to finance a project when a PPA provides ample financial security to the asset owner.

Central to managing the complex and long-term risks of renewables projects are power purchase agreements (PPAs) – bilateral contracts between buyers and sellers of electricity

PPAs have existed for decades in the energy industry, for example between the owner of a gas-fired plant and energy buyers. But more recently, a booming market has developed for PPAs in the field of renewable generation.

Renewable, or ‘green’, PPAs are contracts between the owner of a renewable generation asset (the electricity seller) and an offtaker (the electricity buyer). Just like ‘grey’ PPAs, the ‘green’ PPAs are usually signed for a long-term period of 10–20 years. One reason for the longer contract durations is that each contract requires a certain level of structuring. This requires people and money, so is not something most firms wish to repeat every year. For shorter durations, it is cheaper to trade standard contracts in the market place, like forwards and futures.

Filling the gap

Another reason for the longer contract durations is that many PPAs are concluded at the inception of a new asset. In that phase, the PPA is the main building block to secure the future revenue stream. This is only effective if the revenue stream is secured over a long enough horizon, spanning a large part of the expected lifetime of the asset. At the same time, there is also a growing market for PPAs of existing assets, in particular assets coming out of an FIT. With the end of FITs, the time has come for consumers to step into the space left behind.

Natural players on the buy side of PPA contracts are the supply companies and utilities. They can integrate the electricity in their portfolio, often already comprising the direct ownership and management of other renewables assets. Utilities redistribute the power to the consumers, such as households and businesses. Those end-users can also decide to contract renewable energy directly from the solar park or wind farm. This is the market of so-called corporate PPAs. So far, only the largest corporate companies have entered this space, but the incentives to do so are growing. For a firm wanting to go green, PPAs are increasingly being seen as a good option.

The on-site renewable generation asset is the most tangible, while the green certificate route is the most virtual. PPA contracts sit nicely in between

An alternative would be to develop a renewable generation asset on-site, but that is economical only in a few cases. A second and third alternative to a PPA contract are closely connected: buying green electricity from a supplier, or buying electricity in the wholesale market in combination with green guarantees of origin (GoO). This GoO is an electronic certificate proofing the green nature of the power. With both alternatives, the exact source does not have to be a single known asset, but the supplier or certificate guarantees that it is from a renewable source.

The on-site renewable generation asset is the most tangible, while the green certificate route is the most virtual. PPA contracts sit nicely in between: the actual operation is outsourced, while there is nonetheless a direct connection to one or more specific assets. This is what corporates increasingly prefer. First, it provides direct support to new projects, allowing these to have sufficient bankability to take off. Second, a direct contract allows a company to be associated more closely to the asset, which raises its reputation among various stakeholders, such as customers, employees and investors.

Corporate PPA growth

While there is limited data on PPAs bought by utilities and supply companies, activity on the corporate PPA market – which firms are usually keen to publicise for reputational reasons – is accurately tracked, for example by Bloomberg New Energy Finance. The amount of electricity covered by corporate PPAs more than tripled between 2017 and 2019, to reach 19.5 gigawatts (GW) per year (see figure 1).

Many of the corporate PPAs in Europe have been signed by major US technology companies. For example, Microsoft purchased a PPA from Vattenfall in 2017. The deal covers the production of the 180 megawatt (MW) on-shore windfarm Wieringermeer in the north of the Netherlands.

More recently, in June 2019, Microsoft signed a 15-year PPA deal with Engie, which will supply sites in North America with 11 terawatt hours (TWh) of renewable energy starting in January 2021. Other examples include Google’s September 2019 purchase of 92MW of power from an offshore wind farm in the North Sea; and Amazon Web Services’ PPA deal with bp for 172MW of capacity from solar and wind projects in Europe.

European companies are now following in the footsteps of their US rivals. Examples include the British retailer Tesco and the German car manufacturer Mercedes-Benz. Not surprisingly, the buyers in the corporate PPA market are predominantly producing consumer goods. Here, the reputational and marketing value of being green is arguably the highest of any sector.

Physical or virtual?

A virtual PPA is a financial contract in which the connection between the renewable generation asset and the offtaker is quite loose. For example, the offtaker may be in a different country or bidding zone from the location of the asset. A virtual PPA is essentially a contract-for-difference: for each MWh of power produced by the generator, the buyer pays a fixed price to the generator. In return, it receives from the generator a variable (spot) price plus the GoO. Separate to this virtual PPA contract, the generator can sell its power to the market, and the buyer can source its power from the market (or a supply company) as well.

In a physical PPA, the generator and the offtaker must be on the same grid. A physical PPA is generally sleeved by a utility, meaning that a utility is in between the generator and the offtaker to deliver the actual electricity, especially to manage the volume fluctuations (see figure 2).

For this activity, the utility receives a sleeving fee. With sufficient scale in such operations, a utility benefits from economies of scale and diversification to be of real added value.

Components of PPA value

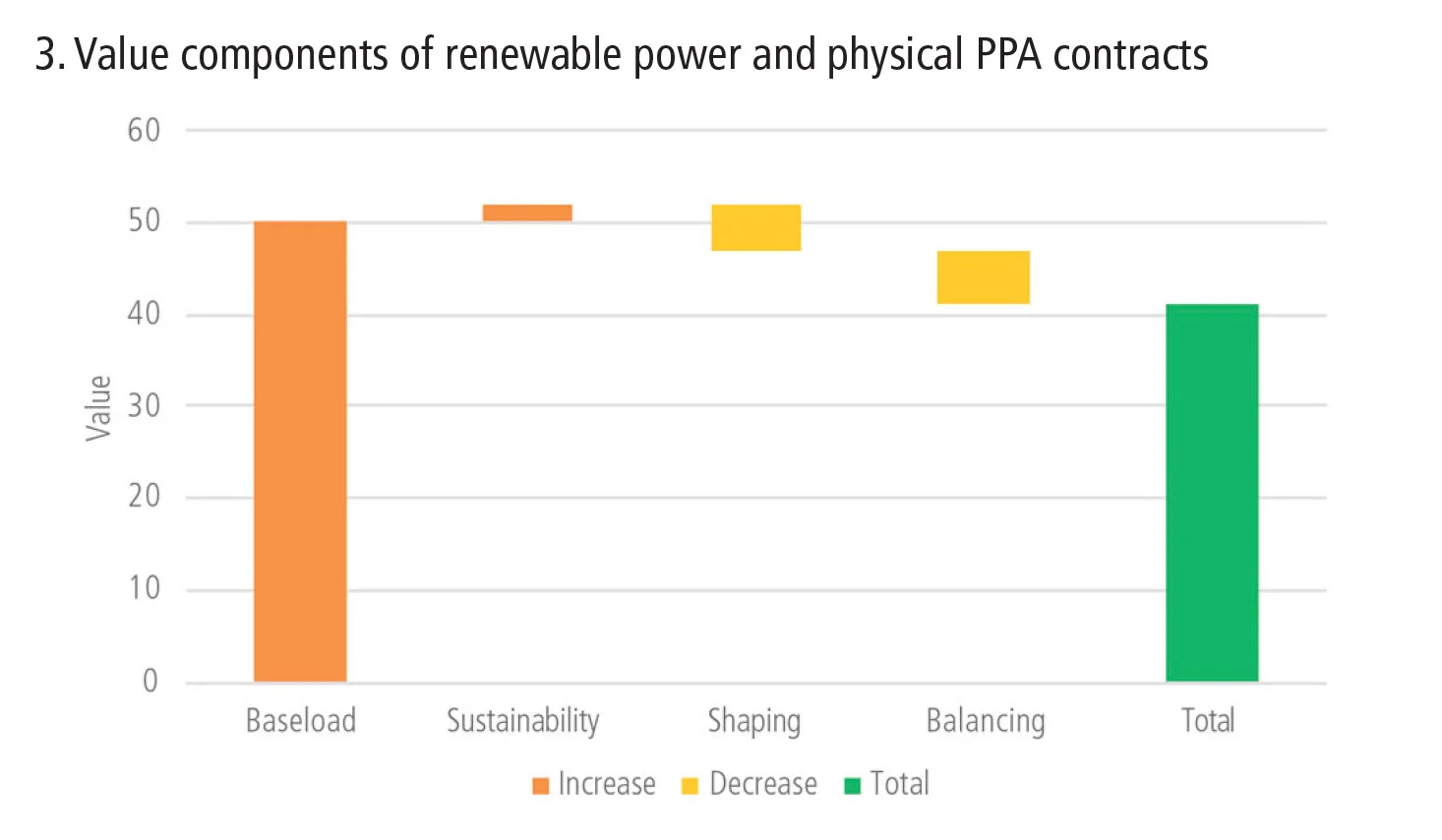

The value of a PPA is derived from a complex inter-relationship of many components (see figure 3). The largest value driver is the baseload power price. This can be a price in the forward market or the estimated average future spot price. Additionally, there is a sustainability premium to factor in. When the demand for green versus grey power is large relative to supply, green power becomes relatively more expensive – in other words, the sustainability premium increases. The GoO price reflects the sustainability premium consumers are willing to pay.

Unfortunately, a renewable generation asset does not produce baseload, and this leads to the shaping and balancing costs. The shaping cost is not a directly observable cost, but rather the difference between the baseload price and the realised (or effective) price in the day-ahead spot market. The larger the share of wind or solar generation in the total supply, the lower are the prices at the time of production. This is the so-called cannibalisation effect – as renewables penetration increases, the capture price of renewable electricity will fall because, once built, renewables facilities generate electricity at no cost. This effect makes it harder to recoup the initial investment. This needs to be factored into investment decisions and PPAs at the start of project development. Investors should take into account how many new renewable projects will be up and running by the time their project comes online and what’s expected in the years to come. At the same time, investors have to consider that the electricity markets will inevitably see an increase in energy storage, demand response and other forms of flexibility. This will have a positive offsetting impact on the capture rates.

The second cost component, balancing cost, results from the intermittent nature of solar and especially wind: their production cannot be forecasted day-ahead with great accuracy. Most of the time, those imbalances will be correlated with the general market imbalances, and therefore constitute a system cost, which the contributor pays for in the form of imbalance charges.

The value breakdown shows that it is far too simplistic to state that the value of renewable power equals the baseload power price times the total generation volume. The ‘real value’ can be much lower, due to the fluctuations and forecasting inaccuracies of the actual generation. In the following articles, we investigate this in more detail.

Cyriel de Jong is founder and director at Kyos Energy Analytics

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: Luna crypto chicanery shrinks Galaxy coffers

Also: Down under and dirty – motor finance scandal comes to Oz, and 2024 in review. Data by ORX News

Why AI will never predict financial markets

Laws that govern swings in asset prices are beyond statistical grasp of machine learning technology, argues academic Daniel Bloch

Podcast: adventures in autoencoding

Trio of senior quants explain how autoencoders can reduce dimensionality in yield curves

Op risk data: Crypto hack bites Bybit; fat-finger flurry at Citi

Also: OKX gets AML scold, UK motor finance fiasco revs up. Data by ORX News

Podcast: Lyudmil Zyapkov on the relativity of volatility

BofA quant’s new volatility model combines gamma processes and fractional Brownian motion

Why the survival of internal models is vital for financial stability

Risk quants say stampede to standardised approaches heightens herding and systemic risks

Shaking things up: geopolitics and the euro credit risk measure

Gravitational model offers novel way of assessing national and regional risks in new world order

Start planning for post-quantum risks now

Next-gen quantum computers will require all financial firms to replace the cryptography that underpins cyber defences, writes fintech expert