Swaps data: have SOFR and Sonia swaps and futures lived up to expectations?

Progress on volumes of SOFR and Sonia swaps and futures

In just two years’ time, Libor could cease to exist, casting uncertainty over the fate of financial contracts worth hundreds of trillions of dollars. Alternative risk-free rates (RFRs) have been selected in core markets and have the backing of the official sector, but it’s not so clear whether they have industry backing.

Given the huge significance and reliance on Libor, there are always going to be voices casting doubt on whether these new RFRs will succeed and the start of a new year is a good point in time for such sceptical views to be aired.

Hard data on open interest, outstanding notional and volumes traded for swaps and futures referencing Libor successors such as SOFR, Sonia and €STR provide some perspective on progress to date. So far, it seems to be a mixed bag.

There’s no doubt RFR derivatives volumes have been increasing over the past year, as an eight-fold jump in SOFR futures open interest attests. But in some of the most established RFR markets – for example Sonia swaps – growth has stalled, particularly at the long end. And there’s little sign of a slowdown in Libor-linked swaps activity in tenors past January 2022 – the benchmark’s assumed end date.

As the clock counts down, the switch from Libor to RFR contracts may need to accelerate to embed those rates in the new landscape. The year ahead will be critical, with some pivotal events to watch out for – not least in October, when CME and LCH change their discounting curve from Fed funds to SOFR for all US dollar swaps.

SOFR futures

Let’s start with the largest currency, US dollars and futures on the SOFR index, and chart the growth in open interest over the past year for the CME and Ice futures.

Figure 1 shows:

- As of December 31, 2019, the combined open interest of these two contracts was $2.1 trillion in notional terms, increasing from $250 billion as of January 31, 2019.

- September 2019 was a significant month, and one that has been covered a lot in the press, with disruption in the repo market and the Federal Reserve stepping in to provide liquidity.

- The data shows that October and November trading volumes continued to significantly increase open interest, which hit new peaks.

- CME market share was 95.5% of open interest, Ice had 4.5%.

To put this $2.1 trillion open interest into perspective, we need to compare with the CME Fed funds futures and CME Eurodollar to see whether the ratio of SOFR open interest to each of these is increasing.

The answer to that is an unequivocal yes.

Between January 31, 2019 and December 31, 2019, SOFR futures open interest has increased from 2% to 22% of CME Fed fund futures and from 2% to 19% of CME Eurodollar. Those are significant jumps indeed and augur well for the success of SOFR trading. We wait to see if CME’s launch of options on SOFR futures this month will add another fillip to volumes and open interest.

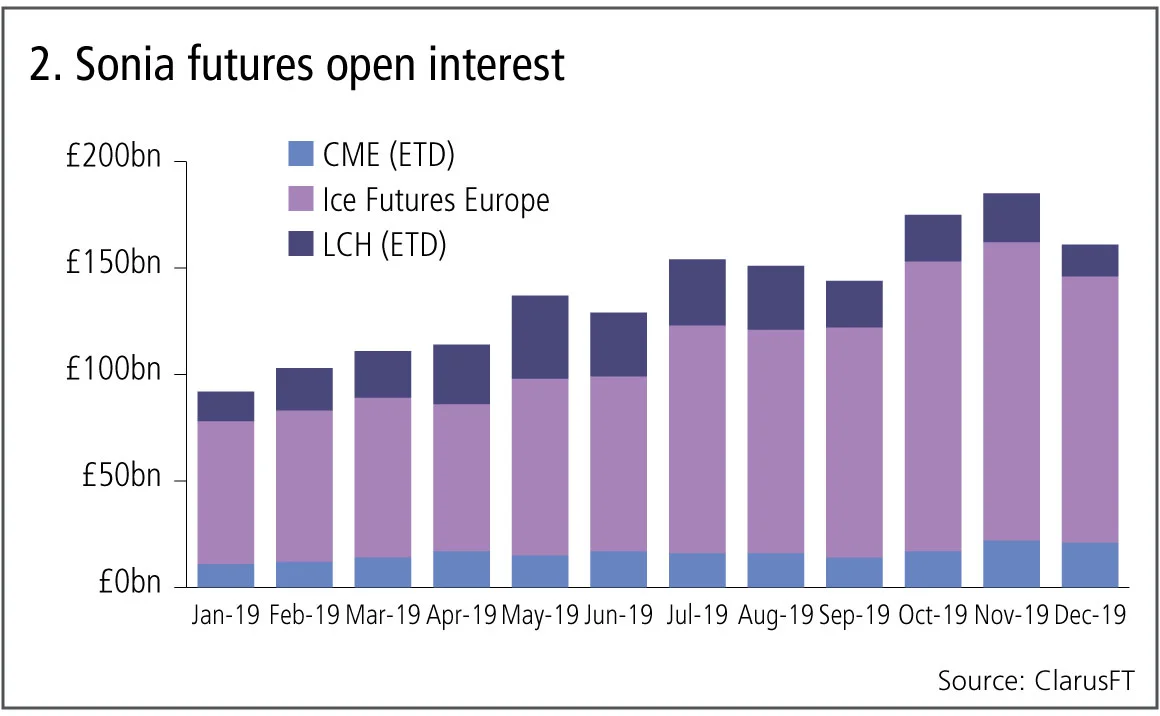

Sonia futures

Next, let’s look at Sonia futures open interest in 2019.

Figure 2 shows:

- Open interest increasing from £91 billion ($118.8 billion) in January to £160 billion in December, an increase of 75%.

- Ice with the largest share, £125 billion or 78% of open interest.

- CME with £21 billion or 13% of open interest.

- LCH, CurveGlobal with £15 billion or 9% of open interest.

We can get a perspective on the £160 billion of Sonia futures open interest by comparing with Ice short sterling and checking if we see a similar increase as evidenced in SOFR.

Between January 31, 2019 and December 31, 2019, Sonia futures open interest has increased from 4.5% to 8.3% of Ice short sterling – so far less than the 20% we saw in SOFR, but evidence of a gain none the less.

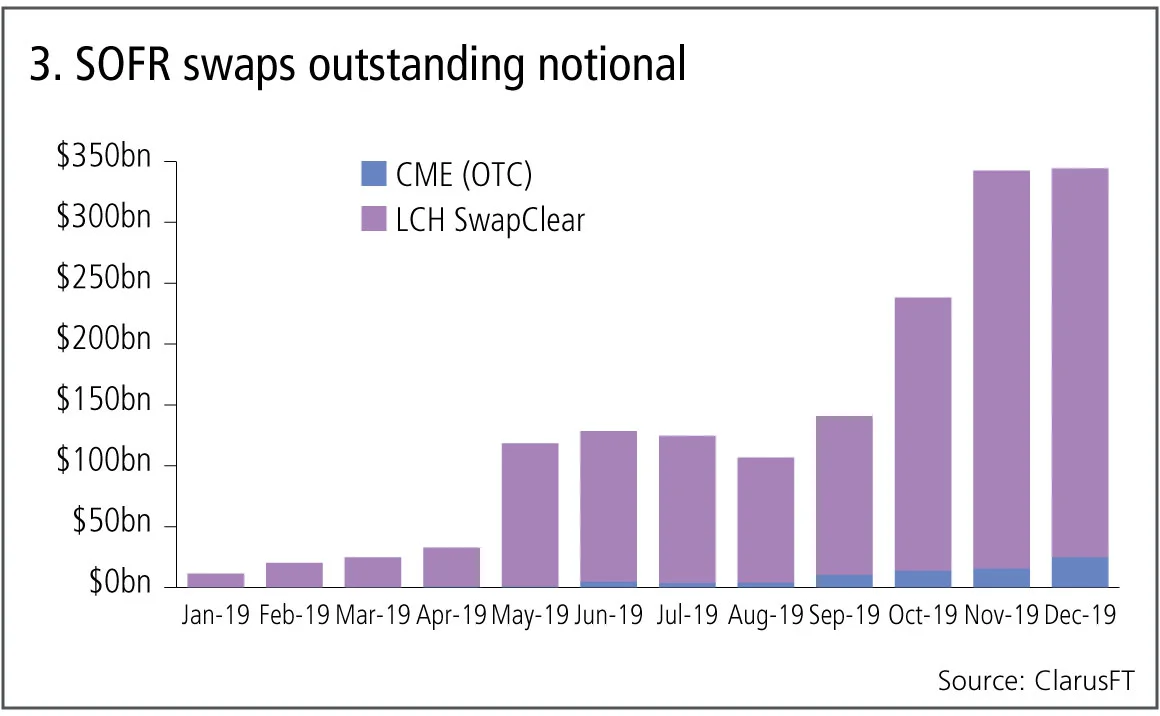

SOFR swaps

Next, let’s look at progress in SOFR swaps trading.

Figure 3 shows:

- Outstanding notional (single-sided) of SOFR swaps at LCH SwapClear and CME over the past year, broken out by month.

- Starting the year at $11 billion and ending at $345 billion, a very respectable increase indeed.

- Large jumps in October and November, meaning that the fourth quarter on 2019 was by far the best quarter in volume growth and it will be interesting to see if the first quarter of 2020 lives up to this rate.

If we follow our futures analogy, we should look to see if the ratio of SOFR swaps outstanding is increasing rapidly compared with Fed funds and Libor swaps.

In this case the jury is still out. As at December 31, 2019, the $345 billion of SOFR swaps notional represents just 3% of Fed fund swaps and 1% of US dollar Libor swaps. The latter ratio of 1% would look even worse if we tenor risk-adjusted the figures as SOFR volume remains dominated by short maturity trades.

It may be that we need to wait until October 2020, the month when CME and LCH change their discounting curve from Fed funds to SOFR, for any real pick-up in volumes.

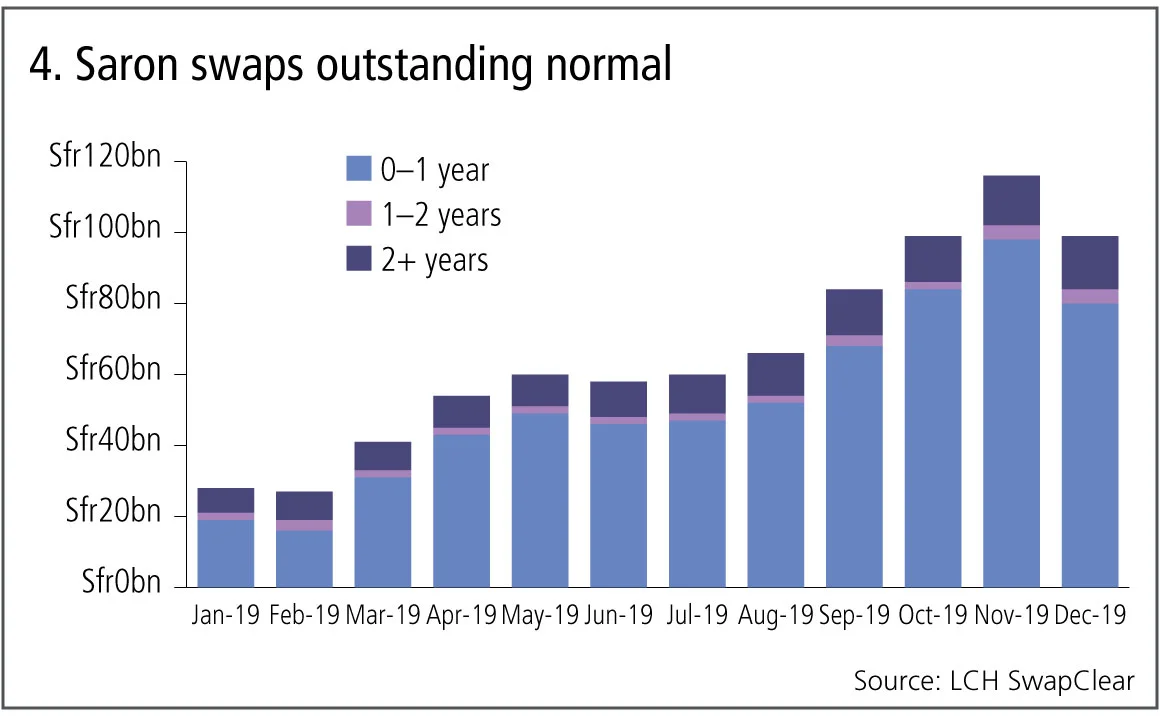

Saron swaps

Next let’s look at swaps in Swiss francs where Saron is the new risk-free rate.

Figure 4 shows:

- Outstanding notional (single-sided) at LCH SwapClear over the past year, split out by the major tenor buckets.

- Total notional increasing from Sfr29 billion ($29.7 billion) on January 31, 2019 to Sfr99 billion on December 2019 – a very decent increase.

- The 0–1 year tenor with the largest increase of 300% from Sfr19 billion to Sfr80 billion, while 2+ year has increased 100% from Sfr7 billion to Sfr15 billion.

And what if we compare Saron OIS swaps to Swiss franc Libor swaps and include volume at CME and Eurex?

On December 31, 2019, that gives us Sfr100 billion Saron to compare with Sfr1 trillion of Libor – a ratio of 10%, and one that has increased from 3.4%, so good progress there, but we need to see more long-term trading in Saron to make a material dent in a risk-adjusted measure.

€STR swaps

€STR is the new risk-free rate in euro markets and while Eonia is now changed to be determined from €STR plus a fixed spread, Eonia swaps continue to trade, but we are now starting to see €STR swaps as well.

I will skip the chart as the data is sparse but LCH SwapClear now has €66 billion ($73.1 billion) of single-sided notional outstanding in €STR swaps from a start in October 2019, while Eonia swaps remain massive with €8 trillion of outstanding notional and Euribor even larger at €25 trillion.

Sterling Libor and Sonia swaps

Finally, let’s turn to sterling, where the existing Sonia rate – after reform – has been selected as the new risk-free rate to replace Libor. The two questions we are most interested in are: first, is swaps volume in Libor decreasing, while Sonia swaps are increasing, and second, are longer tenors trading in Sonia?

Figure 5 shows:

- Monthly gross notional cleared at LCH SwapClear over the past year, split out by the major tenor buckets for Libor swaps.

- Generally the volume trend is up for most of the year and lower volumes in November were to do with market conditions as opposed to any drop in preference for the product.

- The monthly average gross notional in 2019 was £900 billion and December 2019 is close to this figure.

- Open interest ending the year at £5.9 trillion from £5.4 trillion at the start.

So no evidence of a reduction in sterling Libor swaps trading and not even for those with maturity of greater than two years, which would continue past January 2022, the assumed end of Libor.

Let’s now chart Sonia swaps volume and, because the below two-years tenor dominates the figures to such an extent, to make the chart useful we will exclude this tenor, otherwise the monthly average of £1.9 trillion in below two years will dominate the total of £100 billion from all other tenors.

Figure 6 shows:

- The significant jump in August 2019 proved to be a false dawn in terms of a ratcheting-up of levels.

- The thin blue line does show a welcome increase in 50 year, but we really need to see five, 10 and 20 year increase greatly.

To summarise, 2019 saw excellent progress in SOFR futures volumes, some progress in SOFR swaps, Sonia futures, Saron and €STR swaps, but little in Sonia swaps. We need to wait and see what 2020 brings.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why