Credit data: rising default risk for millennial companies

WeWork’s problems hint at the challenges facing companies focused on millennial customers

With its sleek aesthetics, fruit-water dispensers and free beer gimmick, WeWork seemed to perfectly capture the millennial zeitgeist. The co-working company catered to the army of entrepreneurs, start-ups and freelancers that define the gig economy. As millennials became the largest demographic in the workforce, WeWork expanded rapidly. In January 2019, an investment from Japan’s Softbank valued the company at $47 billion.

Then, everything came crashing down. WeWork pulled its planned initial public offering in September after investors questioned its business model and profitability. Almost overnight, its valuation dropped to under $8 billion. In October, Fitch downgraded WeWork’s credit rating to CCC+, deep in junk territory, with a negative outlook.

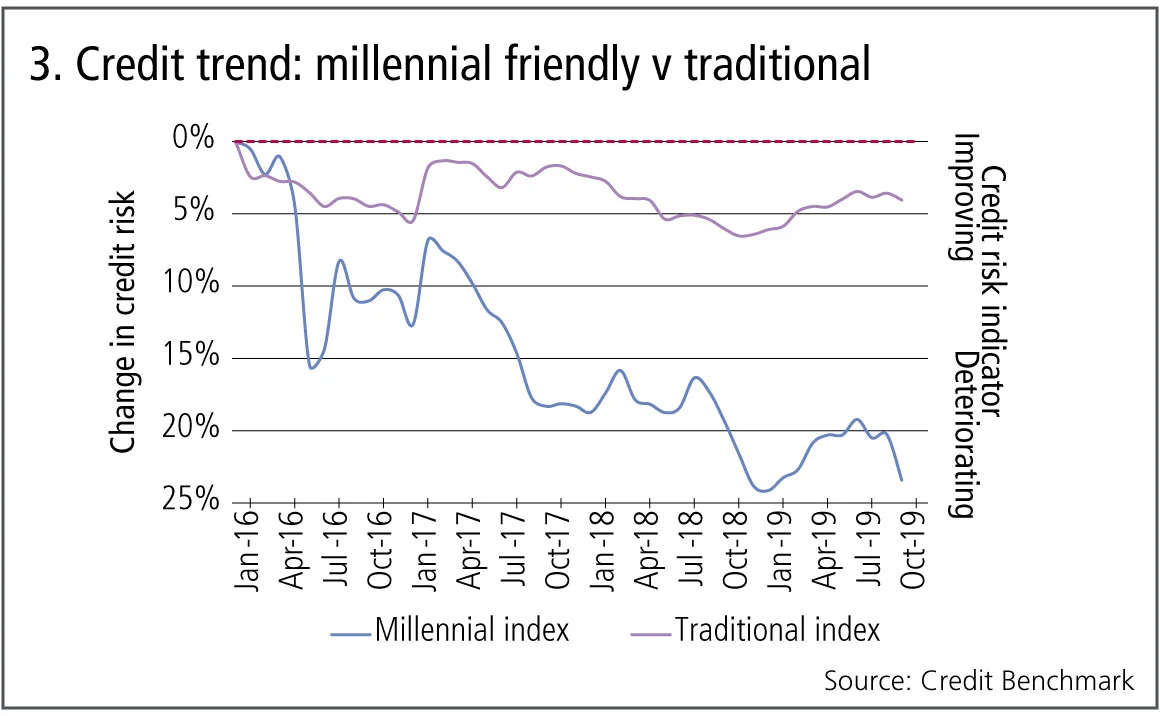

WeWork is an extreme example, but its problems could be a harbinger for other companies reliant on millennial customers. Comparing the credit performance of 57 such businesses to more traditional companies – including a subset of the S&P 500 – reveals a worrying trend. Since 2016, companies focused on millennials have seen their credit quality deteriorate by 24% compared with only 7% for the comparator group.

This shouldn’t be surprising. Companies have spent vast sums chasing millennial consumers. And although millennials have overtaken baby boomers as the largest population group in the US, their spending power still lags far behind older generations.

According to data from the US Federal Reserve, millennials under the age of 40 control just 6.7% of household wealth, compared with 45% for baby boomers aged between 55 and 69. Indeed, the wealth gap between younger and older generations has widened – 30 years ago, when baby boomers were roughly the same age as millennials are now, they accounted for 13.1% of household wealth.

Today, millennials are saddled with higher student debts and housing costs than previous generations, further reducing their disposable income. Many are also eschewing marriage and home-ownership, which have traditionally acted as catalysts for spending.

That could change in the next few years, as millennials pay off their debts and move into better-paying jobs. But for now, lenders should not turn a blind eye to the credit risk of companies touting their millennial bona fides.

Global credit industry trends

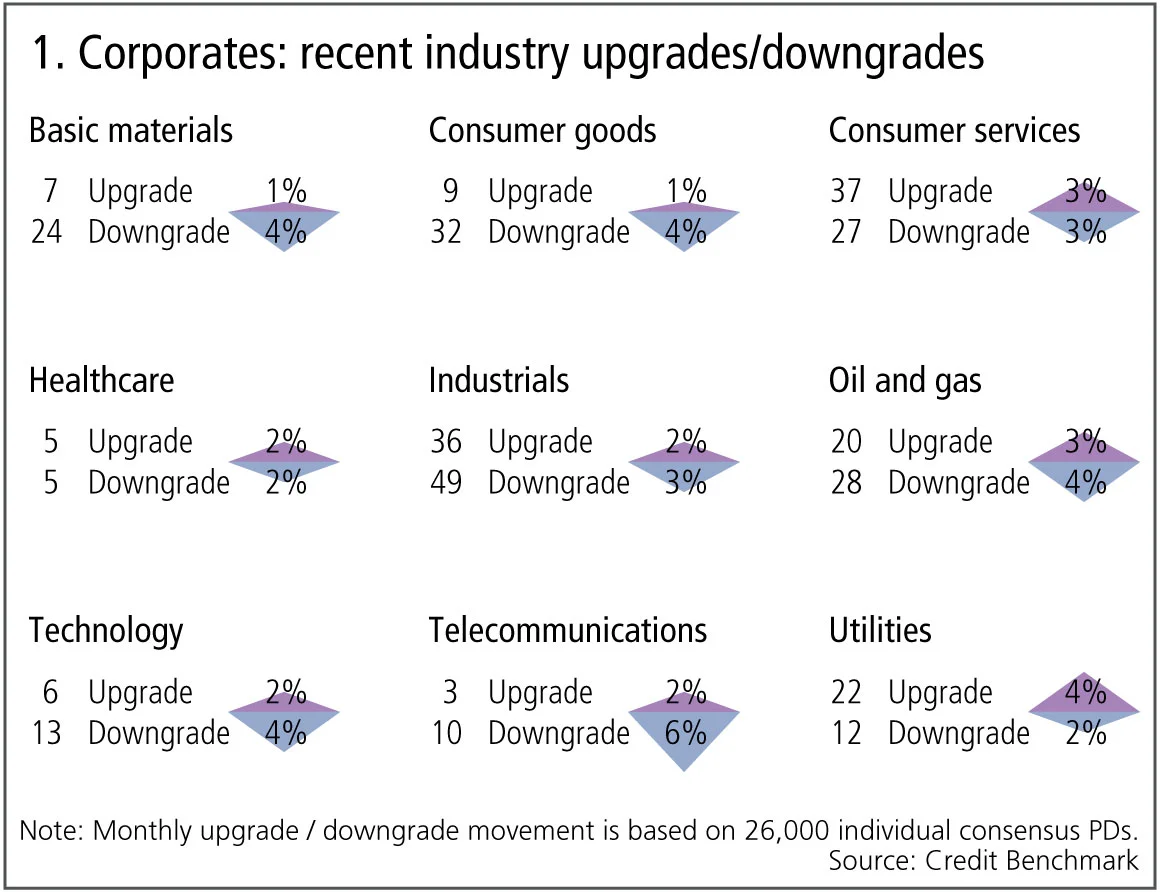

The latest consensus credit data shows that credit activity for corporates and financials has stayed stable, with 4.9% of entities moving by at least one notch, similar to last month. Figure 1 shows detailed industry migration trends for the most recent published data, adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, corporate downgrades outnumber upgrades.

- Upgrades outnumber downgrades in one of the nine industries, six industries are biased towards downgrades and two are in balance.

- Industrials have more downgrades than upgrades for the fourth month.

- Consumer goods and technology continue to see downgrades outweighing upgrades for the third month.

- Basic materials have more downgrades than upgrades for the second month.

- Telecommunications see downgrades outweighing upgrades after two months of upgrades dominating.

- Oil and gas shows volatility, and currently have more downgrades than upgrades.

- Utilities see upgrades outnumber downgrades after two months of balance.

- Consumer services is in balance after a month of downgrades dominating.

- Healthcare is in balance for the second month.

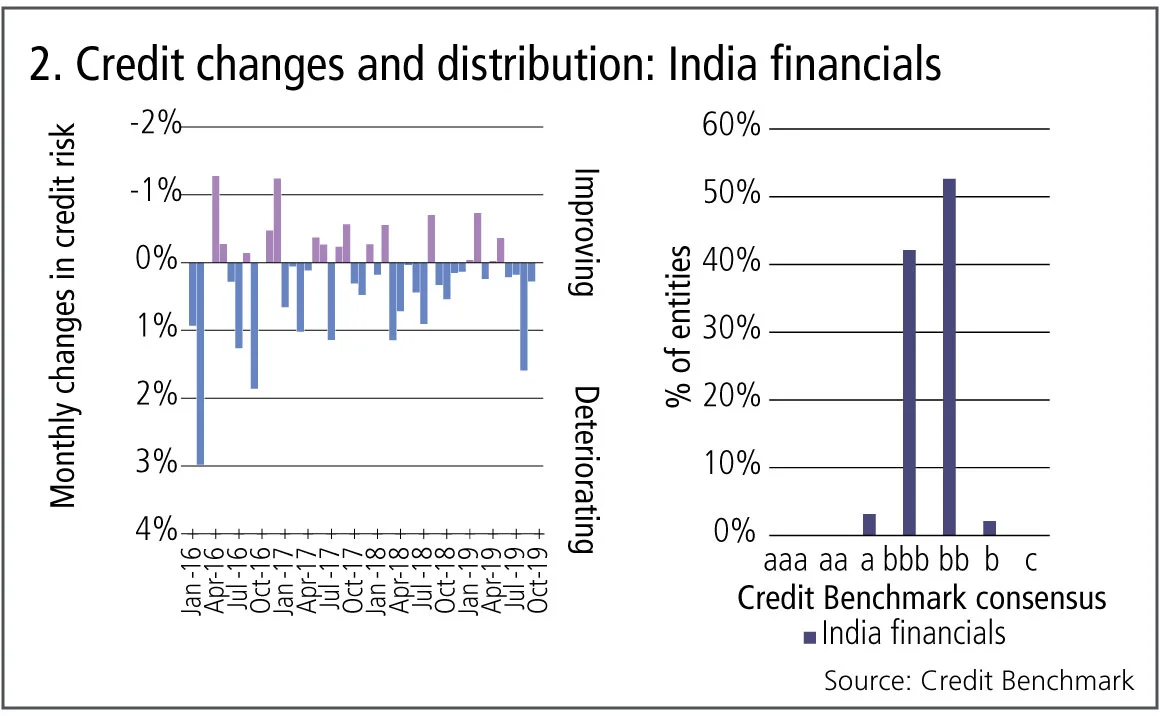

Indian financials

India may be the fifth-largest economy in the world, but it faces significant economic headwinds. Indian lenders are stymied by bad debt – a non—performing loan ratio of 9.3% of total lending ranks India the worst among the top 10 economies – and a large percentage of Indian citizens have limited access to formal banking services. This systemic fragility may account for the credit performance of Indian financials, which have seen a sustained credit quality deterioration.

Figure 2 shows the monthly changes in credit risk of 90 Indian financials.

Figure 2 shows:

- Since January 2016, the credit risk of Indian financials shows 27 months of deterioration versus 17 months of improvement.

- Latest data shows four months of consecutive deteriorations.

- Indian financials are mainly centred about bbb/bb, with no entities in the highest and lowest categories.

Millennial companies

The millennial consumer is still something of an enigma to the corporate world, but most businesses agree on the importance of capturing a market share of a generation that will account for three-quarters of the US workforce by 2030. But are millennial-focused companies a good credit prospect? Credit Benchmark has created an index of US- and UK-based businesses that cater to youthful consumers.

Figure 3 shows the credit trend of 57 millennial-friendly companies and a traditional comparator, which includes a subset of companies from the S&P 500.

Figure 3 shows:

- Both millennial-friendly and traditional companies have seen deterioration in the past two to three years.

- The millennial-focused group has seen a much deeper drop, 24% vs 7% at their respective lows.

- Both sets of companies improved in credit risk from December 2018, although the latest month shows a dip in credit quality.

Automobiles and parts

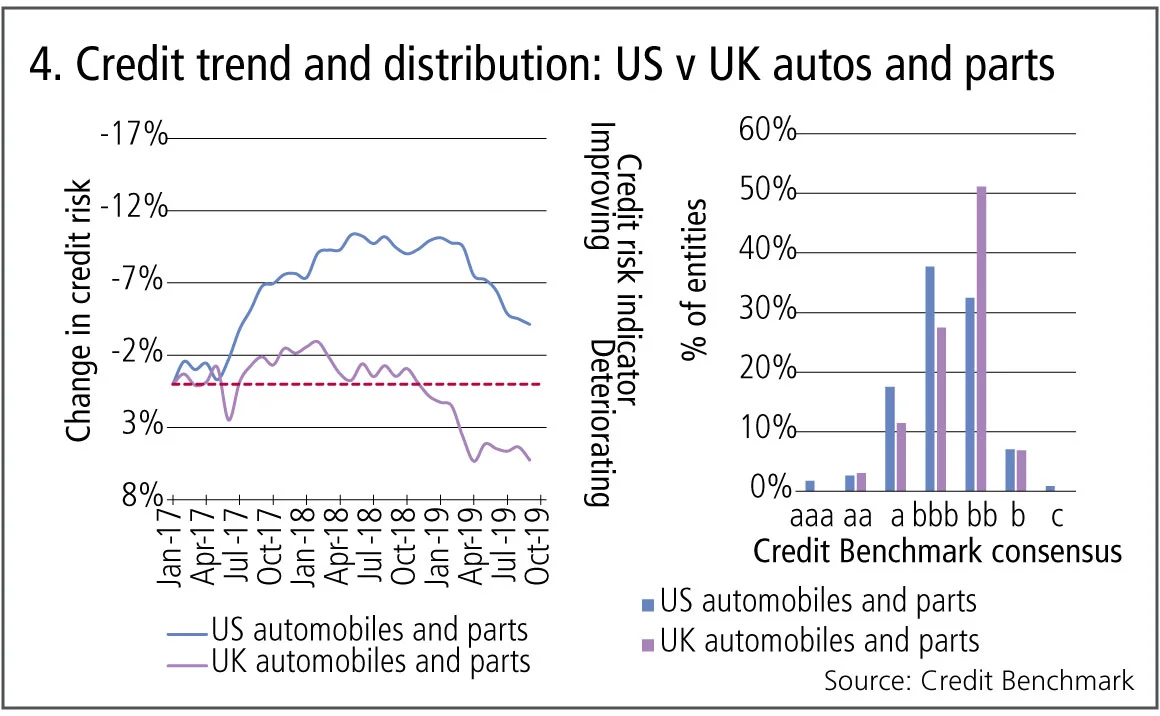

Consensus risk data shows credit risk levels increasing for UK and US automobiles and parts companies. The sector is particularly exposed to the impact of global supply chain challenges and environmental changes. In addition, rising auto loan delinquencies suggest that demand may stagnate in coming months.

Figure 4 shows the credit trend and distributions since January 2017 for 110 US and 130 UK automobiles and parts companies.

Figure 4 shows:

- Both US and UK automobiles and parts credit risk saw a general trend of improvement throughout 2017.

- UK companies were the first to start deteriorating in February 2018. US automobiles and parts continued to improve, but showed signs of stabilisation a quarter later.

- The credit risk of US automobiles and parts started to deteriorate more sharply from the beginning of 2019, with credit risk increasing by 7% since January 2019.

- The majority of US automobiles and parts are in investment-grade category bbb – in comparison more than 50% of UK companies in the sector are in non-investment-grade bb.

Public v private leverage loan issuers

The value of leveraged loans issuance has more than doubled in recent years, from $600 billion in 2012 to $1.4 billion in 2018. This jump implies strong demand by investors for leveraged loans, despite the fact that a significant number of higher-risk “covenant-lite” loans have featured in a number of leveraged loan issues.

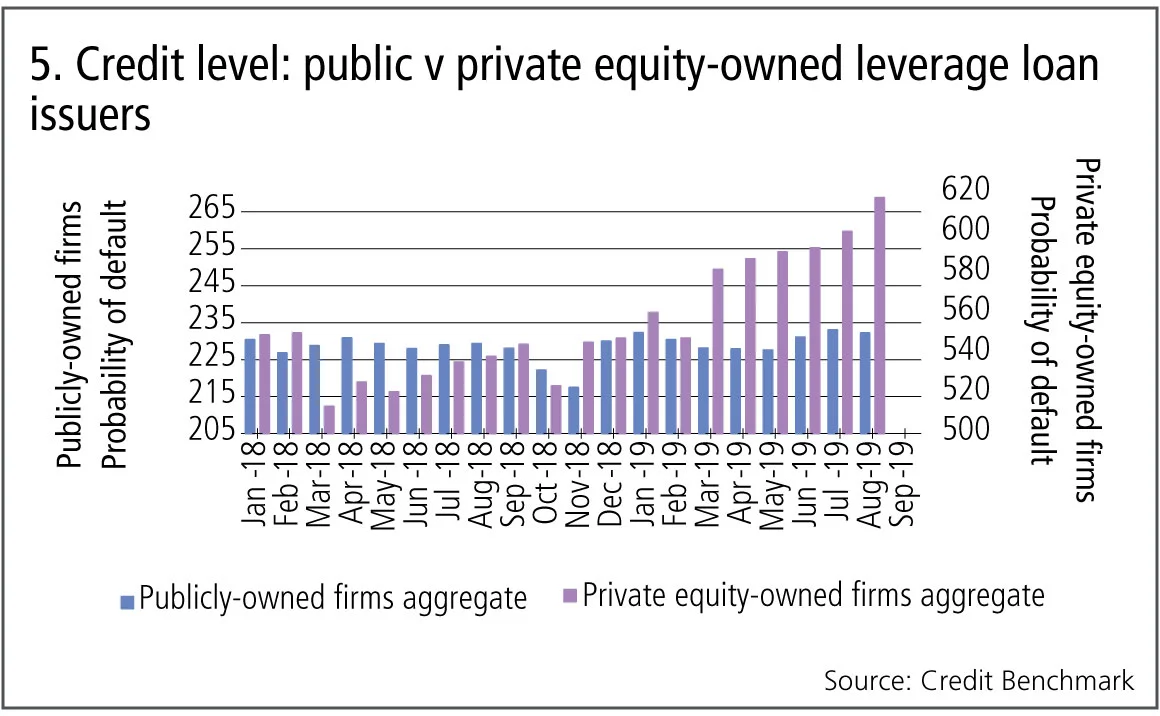

Figure 5 shows credit levels since January 2018 for two groups of leverage loan issuers: 134 publicly listed companies and 63 private equity-owned firms.

Figure 5 shows:

- In the latest month, the average probability of default (PD) of private equity-owned leveraged loan issuers is 618 basis points which corresponds to a consensus rating of b.

- In comparison, publicly listed firms have an average PD of 232bp, corresponding to a consensus rating of bb–, two ratings better than the private equity counterparts.

- Private equity-owned issuer credit risk has deteriorated by 18% since the low of October 2018; while public companies have only seen a rise in default risk of 5% over the same period.

About this data

Credit Benchmark collects monthly credit risk inputs from 40-plus of the world’s leading financial institutions, making it possible to follow credit trends across geographies and industries. In all, the dataset contains consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why

How geopolitical risk turned into a systemic stress test

Conflict over resources is reshaping markets in a way that goes beyond occasional risk premia

Op risk data: FIS pays the price for Worldpay synergy slip-up

Also: Liberty Mutual rings up record age bias case; Nationwide’s fraud failings. Data by ORX News