Credit data: no-deal Brexit threatens UK retail sector

Italian credits are improving, but banking sector is not out of the woods yet

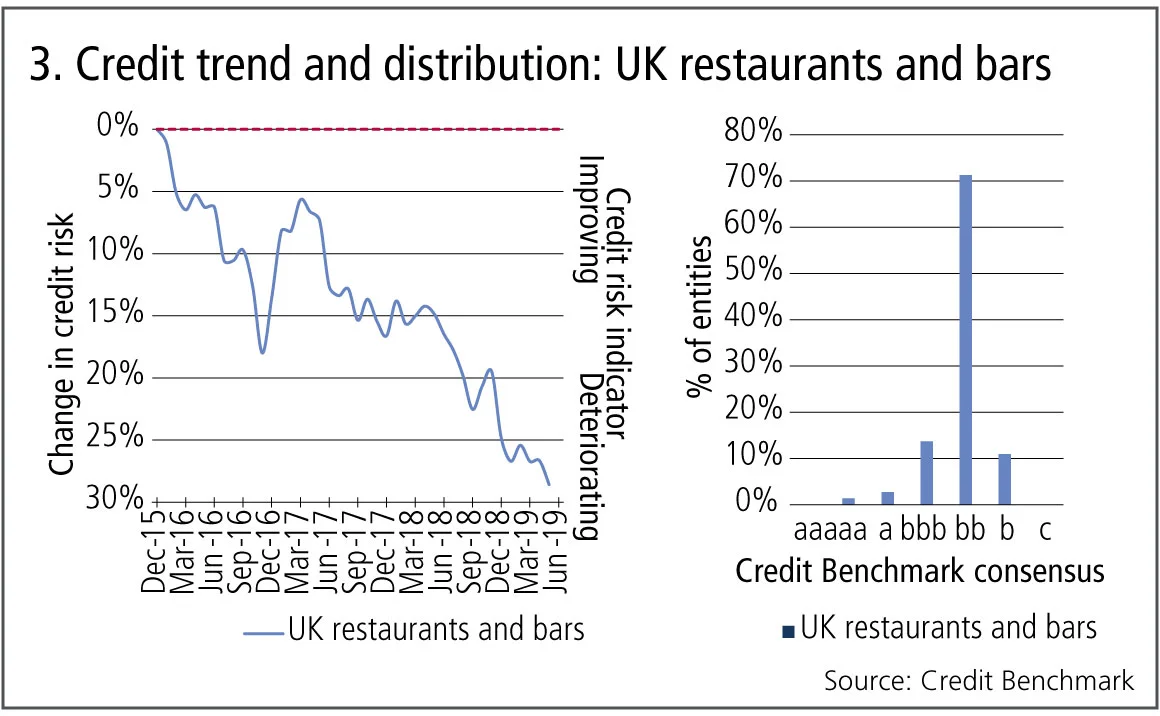

The UK retail sector could be particularly vulnerable to a no-deal Brexit.

New UK prime minister Boris Johnson’s vow to leave the European Union on October 31 with or without a withdrawal agreement has driven fresh weakness in sterling, reducing local purchasing power and quite possibly undermining consumer sentiment. The GfK consumer confidence survey for July shows expectations for the general economic situation over the next 12 months stranded at –32, substantially worse than the level of –26 recorded in the same month of 2018.

In this situation, the UK restaurant and bar sector will be doubly affected, through lower customer footfall and increased food import costs.

According to Credit Benchmark data, sourced from financial institutions„ the credit risk of 50 UK companies in this sector has deteriorated by almost 5% since the start of 2019 alone, with more than 80% now judged to be below investment grade.

A no-deal Brexit will do further damage to a sector that has already seen the Patisserie Valerie café and Jamie Oliver restaurant chains collapse into administration this year.

This is just part of a wider story of weakness in the UK corporate sector, which has the lowest implied credit quality of any major western European country, below investment grade. Even Italian corporates are in better shape, according to bank credit risk managers, despite a higher overall level of non-performing loans in Italy. According to data from the European Banking Authority, the stock of NPLs in Italy in the first quarter of 2019 stood at 8.3%, compared with just 1.3% in the UK.

By contrast, credit fundamentals for UK banks are relatively resilient, with the aggregate rating well inside investment grade. Italian banks are in a much weaker position, only just clinging on to investment grade status overall, and they are the only banking sector in the sample that is considered weaker than non-financial corporates in the same country.

Nonetheless, the condition of Italian banks has improved substantially in recent years, with the NPL rate dropping from 14.8% in the first quarter of 2017. Further improvement depends on a steady macroeconomic environment, which has been called into question by disputes over the sustainability of the budget deficit. The European Commission launched an excessive deficit procedure against Italy in June.

According to data from the EBA’s 2018 transparency exercise, almost 57% of Italian banks’ sovereign credit exposure is to their home government, making them acutely vulnerable to any fiscal deterioration. Italy therefore joins the UK as the two European countries where credit quality is most at risk from political volatility.

Global credit industry trends

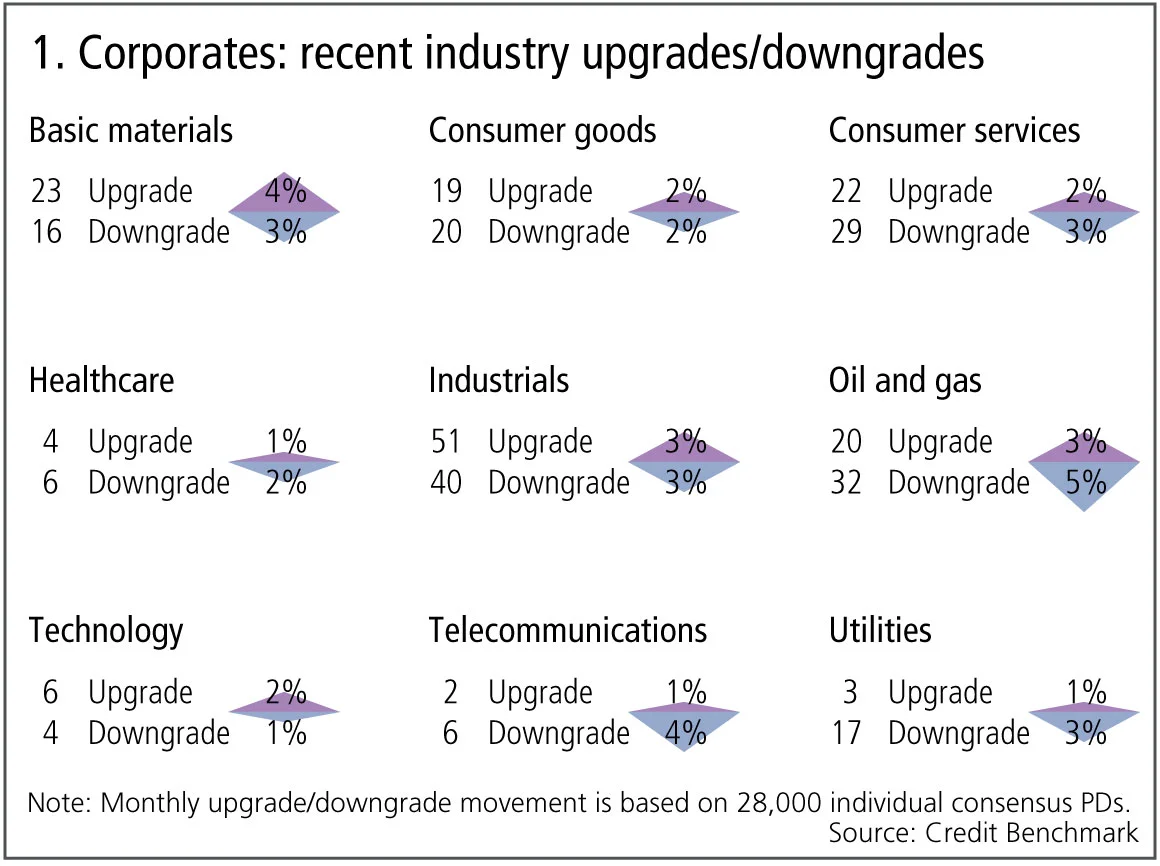

The latest bank-sourced credit data shows upgrade and downgrade activity has increased, with 723 companies moving by at least one notch, compared with 558 companies the previous month. Figure 1 shows detailed industry migration trends for the most recent published data, based on data adjusted for changes in contributor mix.

Figure 1 shows:

- Globally, the number of corporate upgrades and downgrades are in balance.

- Upgrades outnumber downgrades in two of the nine industries, five industries are biased towards downgrades and two are in balance.

- Basic materials continue to see upgrades dominating, a trend that has lasted more than half a year.

- Consumer services and healthcare continue to see downgrades dominating, continuing their trends from last month.

- Technology returns to upgrades outnumbering downgrades after two months of balance.

- Utilities and oil and gas see downgrades outweigh upgrades after periods of balance, which were preceded by a number of months that saw upgrades dominating.

- Telecommunications return to downgrades outweighing upgrades after a month of balance.

- Industrials continue to be in balance for the third month.

- Consumer goods are volatile with upgrades and downgrades now in balance.

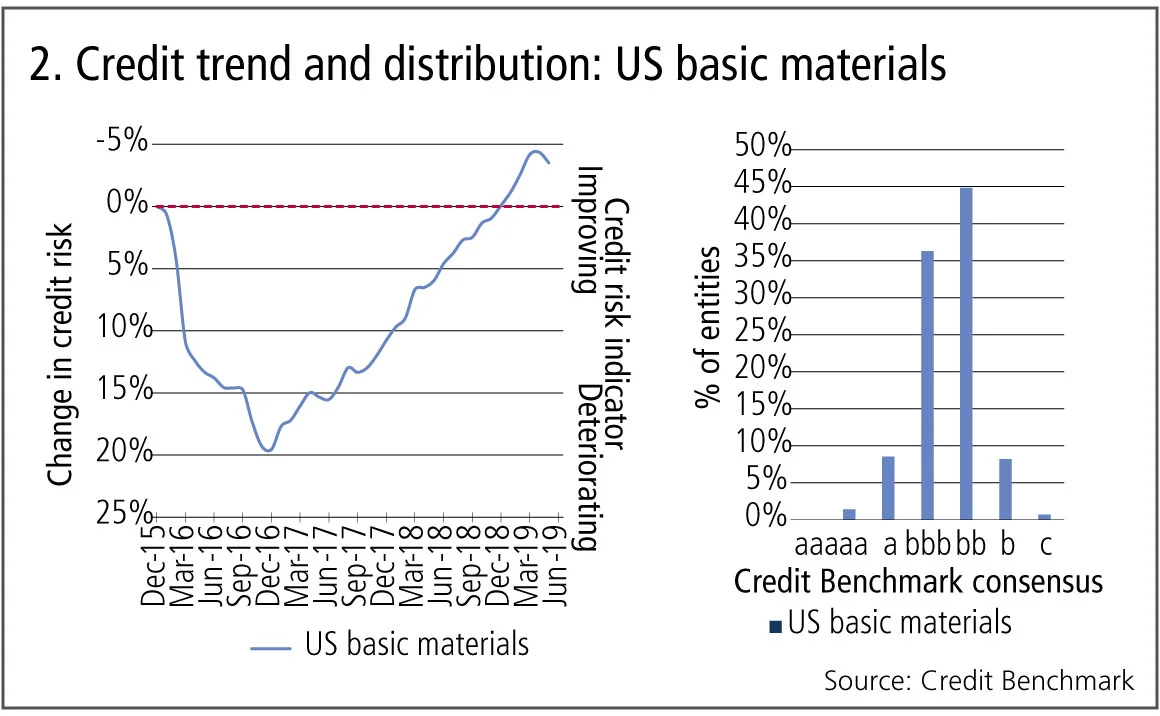

US basic materials

After numerous rounds of US tariffs on Chinese goods, China has hit back with tariffs ranging from 5% to 25% on imports from the US, including chemicals and coal. The US has recently imposed further tariffs after the December 2018 trade war truce.

Figure 2 shows the credit distribution and trends for 180 US basic materials companies.

Figure 2 shows:

- US basic materials deteriorated by nearly 20% from December 2015 to December 2016. From December 2016, they made a steady recovery, exceeding the December 2015 level in December 2018.

- The latest data shows signs of a possible turning point, with credit risk increasing for the first time since September 2017.

- The distribution shows that the majority of US basic materials are close to the boundary of investment grade/non-investment grade, with more than 80% having a Credit Benchmark consensus of bbb/bb.

UK restaurants and bars

The UK restaurant sector has been turbulent due to overexpansion, high debt levels, Brexit-related economic uncertainty and declining consumer confidence: the GfK consumer confidence index has been negative since mid-2016. Closures have hit Byron Burger, Carluccio’s, Gourmet Burger Kitchen, Jamie’s Italian, Prezzo and Strada.

Figure 3 shows the credit trends and distribution of 50 UK restaurants and bars.

Figure 3 shows:

- Except for a bout of recovery in the first quarter of 2017, UK restaurants and bars have seen a significant deterioration in credit risk throughout the last three years. Between December 2015 and May 2019, the credit risk of UK restaurants and bars has deteriorated by nearly 30%.

- The credit level of UK restaurants and bars is highly concentrated in the non-investment-grade category of bb, accounting for more than 70% of the sector.

European corporates and financials

European economic numbers have been lacklustre and political upheavals have added to business concerns. The Brexit effect seems to be confined to the UK, but Europe is tackling sluggish core growth, hampered by persistent legacy bank problems (Deutsche Bank is downsizing, Italy still has bad loan problems – albeit down from 17% in 2015 to 11.4% currently). Spain, on the other hand, has the fastest GDP growth in the eurozone, with 2018 being the fifth consecutive year of expansion.

Figure 4 shows the credit levels of the corporates and financials of several European countries.

Figure 4 shows:

- For the majority of European countries, financials have a better credit risk than their corporates counterparts. The exception to this is Italy, where the credit risk of financials is slightly worse than corporates, although within the same Credit Benchmark consensus of bbb–.

- UK corporates have the highest credit risk of European corporates and financials, being the only non-investment-grade sector of bb+.

- Sweden financials have the best credit risk, the only sector with a Credit Benchmark consensus of a, and very close to the boundary of a+.

UK industrials

Credit trends for UK corporates have made grim reading over the past few years. Brexit uncertainty is probably the main driver, but fiscal austerity has also contributed. Within this extended period of deterioration there have been some short-lived recoveries, but – so far – these have proved to be false dawns. The UK industrials industry is a good barometer of British credit health, with companies that include Costain, East Midlands Railway, G4S, Heathrow Airport and Rolls-Royce. The latest data suggests another respite, but the next few months will be crucial as the UK heads towards yet another Brexit deadline.

Figure 5 shows the credit consensus indicator for UK industrials. The CCI shows an improvement (deterioration) in credit quality if the CCI value is above (below) 50, a value of 50 is classed as neutral.

Figure 5 shows:

- The latest CCI data on UK industrials shows that there has been a marginal improvement, with the CCI of 50.4; a value greater than 50 indicates that credit quality is improving.

- The improvement seen in the latest month was preceded by six consecutive months of deterioration, however it can be seen that the breadth of the deterioration has been dropping, indicated by the shrinking red bars from December 2018 to April 2019.

About this data

Credit Benchmark collects monthly credit risk inputs from 40-plus of the world’s leading financial institutions, making it possible to follow credit trends across geographies and industries. In all, the dataset contains consensus ratings on about 50,000 rated and unrated entities globally.

David Carruthers is head of research at Credit Benchmark.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Podcast: Gordon Lee on how junior quants can go from newbie to MVP

Prioritising tasks and setting boundaries are key to career progression, says BNY’s head quant

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty