Swaps data: a new era of competition in interest rate futures

The demise of Libor has set off a battle for market share in futures referencing new risk-free rates

The interest rate futures market has long been a cosy place for incumbents.

Market participants prefer to have a single, deep pool of liquidity for trading, and the big exchanges have obliged by carving up most of the major interest rate contracts between them. For each currency, one exchange is dominant: CME prevails in US dollars; Ice rules Euribor and sterling; Eurex holds sway over euro bonds; and ASX reigns in Australian dollars. So far, the vertical model of trading and clearing has held out against the horizontal model of open access seen in most other markets.

The demise of Libor could change all that, unleashing a burst of competition among exchanges in contracts linked to the risk-free rates (RFRs) that will replace Libor.

In the US, contracts linked to the secured overnight funding rate (SOFR) will eventually supplant CME Eurodollar – the world’s most actively traded futures contract. Ice is making a play, but CME seems to be having no trouble holding off the challenge.

Ice’s dominance in short sterling futures appears to be under greater threat. CurveGlobal’s Sonia contracts, which are cleared at LCH SwapClear and can be cross-margined against interest rate swaps there, have grabbed a 29% market share, with open interest up 170% since January. CME is also making a push, and currently has 12% of open interest.

Trading in futures referencing alternative euro RFRs is yet to begin, but expect to see CME, CurveGlobal, Ice and Eurex actively competing for control of the market when it does.

While the transition to new RFRs has some years to run, let us look at what trading volume tells us about the future of interest rate futures.

Money market futures

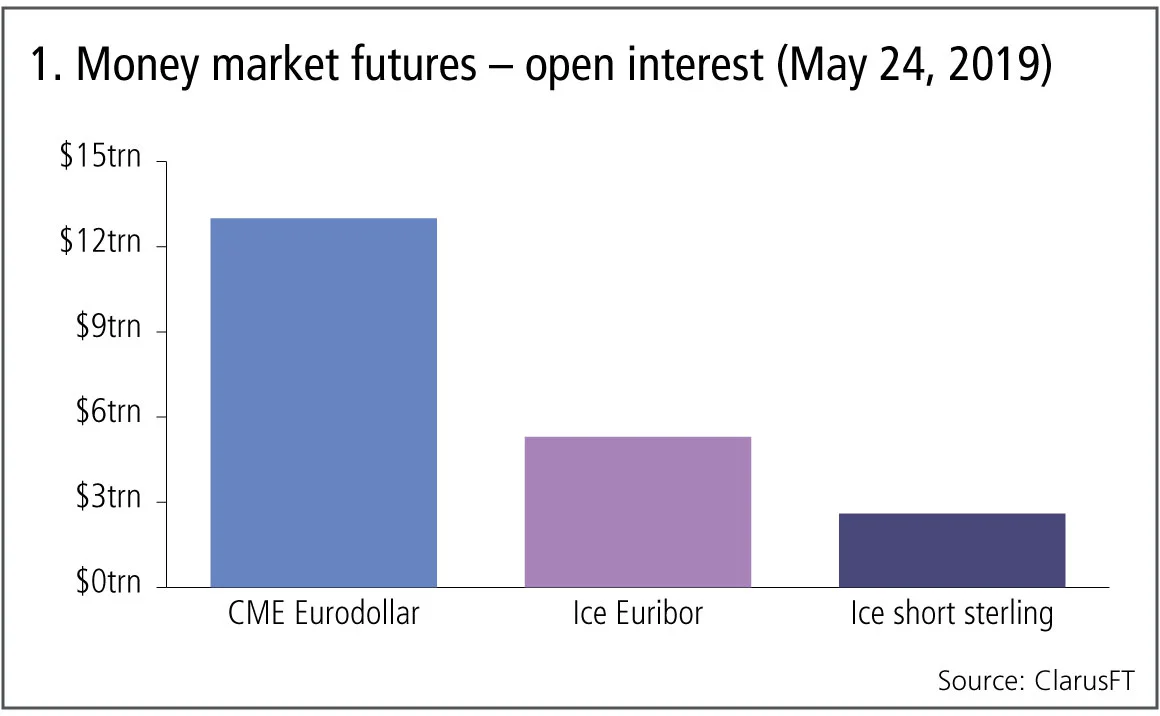

We start by looking at three of the largest futures contracts – CME Eurodollar, Ice Euribor, Ice short sterling – each of which reference an interbank offered rate (Ibor).

Figure 1 shows:

- Open interest as of May 24, 2019.

- CME Eurodollar is by far the largest with $13 trillion of open interest in notional amount or 13 million contracts.

- Ice Euribor is next with $5.3 trillion open interest or 4.7 million -contracts.

- Ice short sterling with $2.6 trillion open interest or 4 million contracts.

The massive open interest and volumes in these contracts reveals both the scale of the challenge, and the opportunity ahead for new contracts.

SOFR futures

In US dollars, the Alternative Reference Rates Committee has selected SOFR as the replacement rate for US dollar Libor and announced a paced transition plan for an orderly transition. The launch of new futures contracts, and increasing volumes in these, are an important step in the transition.

Figure 2 shows:

- Open interest in US dollar amounts at each month end in 2019, up to May 24.

- CME SOFR futures now have $465 billion of open interest, up from $216 billion on January 31, 2019 – an increase of 116%.

- SOFR futures are now among CME Group’s top five most successful products, ranked by average daily volume in the last three months of the first year of trading.

- Ice SOFR futures have $51 billion of open interest, up 66% from $31 billion on January 31, 2019.

- Market share in open interest terms on May 24, 2019 is 90% to CME and 10% to Ice.

Total SOFR futures open interest of $516 billion is just 4% of the $13 trillion for CME Eurodollar, which shows the mountain to climb. However the first year of trading in these contracts is encouraging and it will be interesting to see both how volumes develop in the next six months. Will CME grab all the market share, or can Ice establish a sizeable share?

Sonia futures

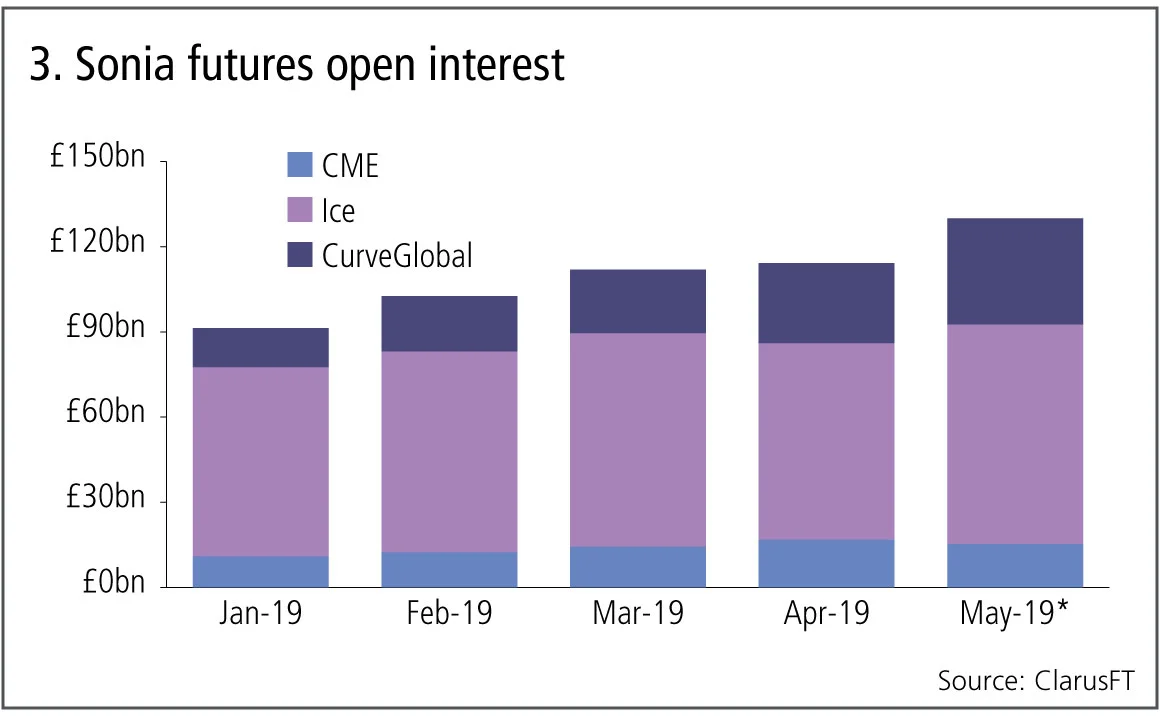

Next, let’s look at sterling and Sonia futures.

Figure 3 shows:

- Open interest in sterling amounts at each month end in 2019, up to May 24.

- Ice has the most open interest at £77 billion ($97.8 billion), up 16% from £66 billion on January 31, 2019.

- CurveGlobal is next with £37 billion up 170% from £13.8 billion.

- CME has £15 billion, up 40% from £11 billion.

- Market share in open interest terms on May 24, 2019 is 59% to Ice, 29% to CurveGlobal and 12% to CME.

Total Sonia futures open interest of £130 billion is just 6.4% of the £2 trillion of Ice short sterling. However, the competition here looks much more intense than in US dollars, with three exchanges vying for dominance.

CurveGlobal’s Sonia contracts, which are cleared by LCH SwapClear and available to portfolio margin against interest rate swaps, are up significantly in 2019 and particularly so in May.

It will be interesting to see how the respective market shares of 59%, 29% and 12% play out over the remainder of the year.

Euribor futures

I would now expect to look at futures volumes in the euro alternative reference rate, however we will need to wait some time for that. While €STR has been selected to replace Eonia, it is not yet published and consultations on Euribor are ongoing. So let’s look at Euribor futures in more detail.

Figure 4 shows:

- Ice is dominant in Euribor with €4.7 trillion ($5.97 trillion) of open interest, representing 92.6% of total open interest on May 24, 2019.

- CurveGlobal has €366 billion of open interest, representing a 7.2% share, up 58% from €232 billion on January 31, 2019.

- Eurex has just €9 billion of open interest, but as the dominant player in euro bond futures, must be expected to compete for a new reference rate contract.

So, the battle lines are drawn. CME Group, the dominant exchange for US dollar contracts, with Eurodollar and FedFunds, has grabbed the lead in SOFR with a 90% share, while Ice is making a play. Ice, the dominant exchange in sterling, has the lead in Sonia futures with a 59% share, with both CurveGlobal and CME making a play. Euro alternative reference rates futures trading is yet to launch, but expect to see Ice, CurveGlobal and Eurex compete for this.

History shows that in futures trading, one venue wins out and grabs all the volume. Will this happen in RFRs? Or will new entrants such as CurveGlobal establish unique propositions and corner significant market share? Only time will tell.

Amir Khwaja is chief executive of Clarus Financial Technology

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why