Swaps data: SOFR swaps slip, futures flip

After a banner month for the young OTC instrument in January, volumes then halved

With Libor rates on borrowed time, the adoption of new risk-free rates (RFRs) is being closely watched. Last month’s data revealed increased activity in derivatives linked to the secured overnight funding rate (SOFR), with both SOFR futures and swaps volume hitting new highs.

This month brings mixed tidings. On the one hand, open interest in SOFR futures traded at CME almost doubled. On the other, SOFR swaps volume is half what it was a month ago.

Meanwhile, RFRs for other major currencies, including sterling and the Australian dollar, are seeing more activity.

CME SOFR futures

February saw a big jump in volume and open interest.

Figure 1 shows:

- A record month, with volume touching $1 trillion, compared with $600 billion a month before.

- Both one-month and three-month contracts saw higher volumes.

- A clear trend of month-on-month increases.

Just as importantly, open interest almost doubled from $216 billion at the end of January to $400 billion at the end of February.

Futures volumes are coming along very well and it will be interesting to see if the trend holds over the course of this year.

SOFR swaps

What about swap volumes? Using US trade repository data, we can isolate swaps that reference the SOFR index. In this case, the data is disappointing.

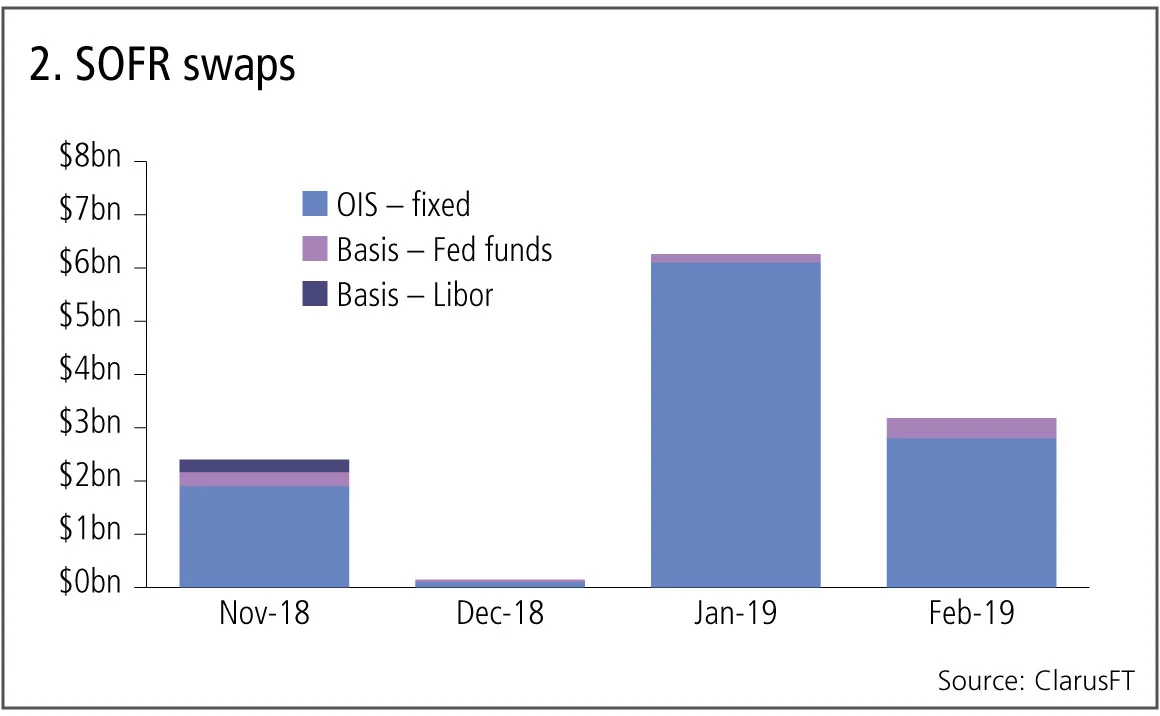

Figure 2 shows:

- Volumes are down, with only $3.2 billion gross notional.

- Only 24 trades were reported by US persons.

- Of these, 16 were SOFR versus fixed overnight indexed swaps, and six were SOFR versus Fed funds basis swaps.

SOFR swaps still have a long way to go. But it is early days for the Alternative Reference Rate Committee’s paced transition plan and, as 2019 progresses, we expect to see a sharp pick-up in volume.

Aonia and Sonia swaps

For comparison, we can look at the RFR replacements for two major currencies: the sterling overnight interbank average (Sonia) and the Reserve Bank of Australia cash rate, also known as Aonia.

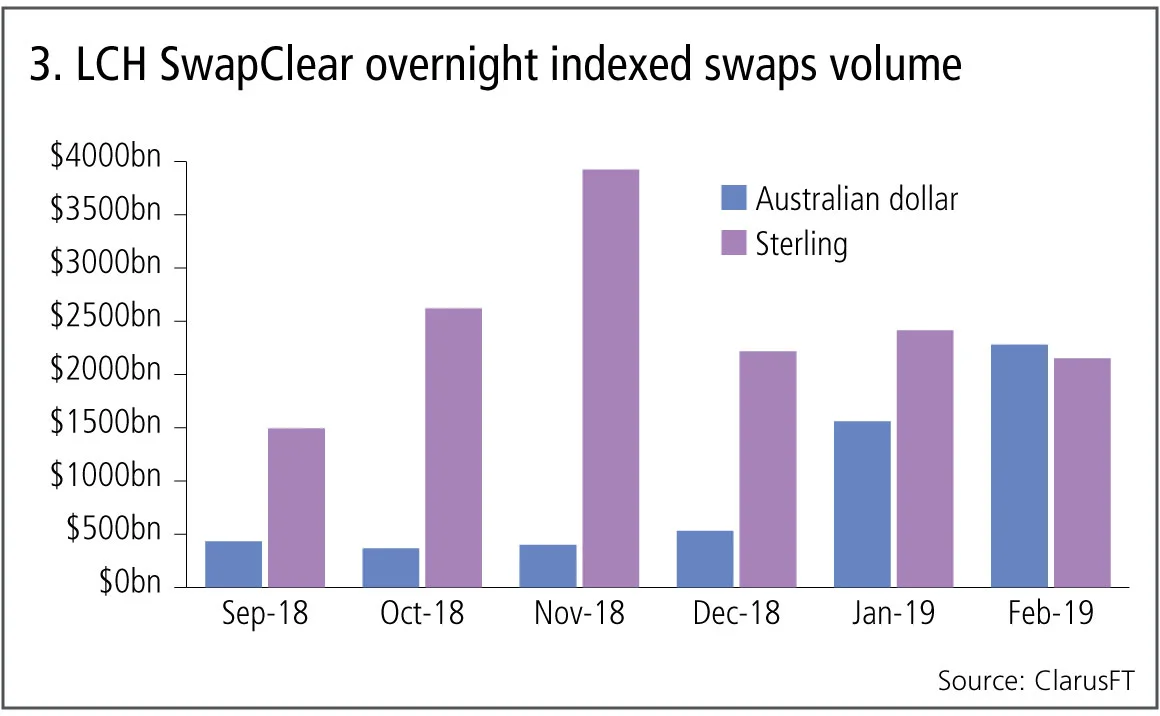

Figure 3 shows:

- The chart shows monthly volumes of Australian dollar and sterling OIS swaps at LCH SwapClear.

- For the first time, Australian dollar volume exceeded sterling, a result of recent uncertainty in the direction of the RBA cash rate.

- Sterling Sonia reached an all-time high of $3.9 trillion in single-sided gross notional in November 2018.

While Sonia is only cleared in material amounts at LCH SwapClear, Aonia also sees significant volume at ASX, which had record months in January and February, with A$250 billion and A$414 billion, respectively, of single-sided gross notional.

Aonia and Sonia are healthy markets. While sterling generally sees more gross notional trades in OIS than interest rate swaps, this was also true for Australian dollars in the months of January and February.

Now, let’s look at the maturities that are traded.

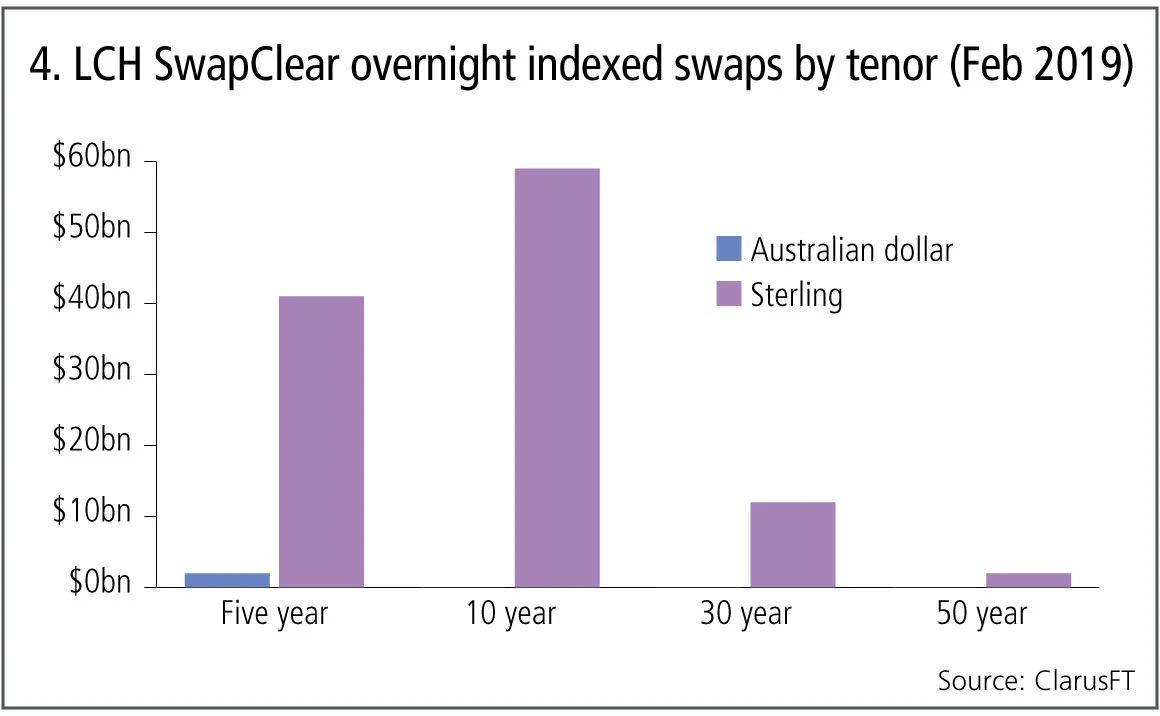

Figure 4 shows:

- This chart excludes tenors below two years, which have the bulk of the volume and would dwarf the remaining tenors if included.

- For the Australian dollar, there is just $2 billion in the two- to five-year bucket, and nothing in longer tenors.

- Sterling has $41 billion single-sided gross notional in the five-year, $59 billion in the 10-year, $12 billion in the 30-year and $2 billion in the 50-year.

Little to no trading happens in Aonia above two years. Sterling has some volume in each of the five-, 10- and 30-year tenors, but there is a long way to go compared with the $2 trillion in volume below two years.

Eonia and Fed funds swaps

Finally, there are two extremely well-traded overnight index swap rates that have not been chosen as replacement RFRs for their respective currencies: Eonia and Fed funds.

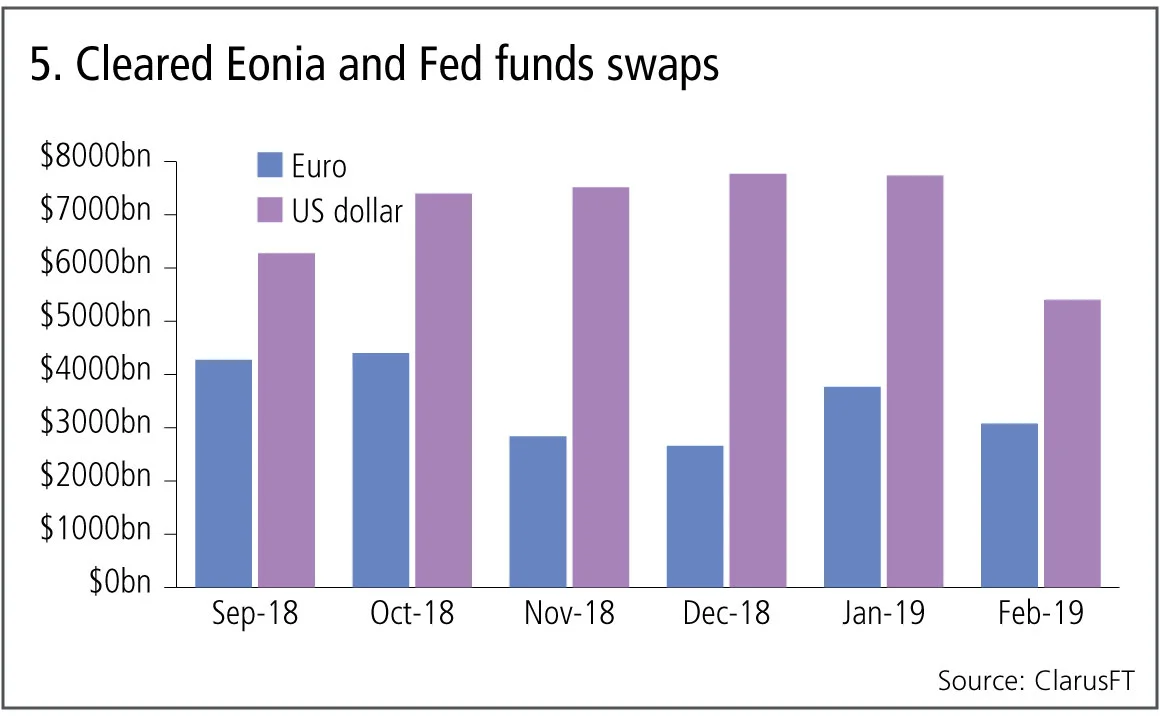

Figure 5 shows:

- The chart shows cumulative volume at LCH, CME and Eurex by -currency for each month.

- Fed fund swaps gross notional hit $7.7 trillion in December and -January, but fell sharply in February to $5.4 trillion.

- Eonia gross notional stood at $3.8 trillion in January and $3.1 trillion in February.

This shows how far SOFR has to go. It will take some time to get from the current $3 billion a month to anything approaching the $7 trillion traded in Fed funds. The euro short-term rate (Ester), which is yet to be published, has an even bigger mountain to climb. It will be interesting to see how long it takes for these new RFRs to surpass existing overnight index swaps and Libor swaps.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Italy’s spread problem is not (always) a credit story

Occasional doubts over Italy’s role in the monetary union adds political risk premium, argues economist

Markets never forget: the lasting impression of square-root impact

Jean-Philippe Bouchaud argues trade flows have a large and long-term effect on asset prices

Podcast: Pietro Rossi on credit ratings and volatility models

Stochastic approaches and calibration speed improve established models in credit and equity

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Beyond the hype, tokenisation can fix the pipework

Blockchain tech offers slicker and cheaper ops for illiquid assets, explains digital expert

Rethinking model validation for GenAI governance

A US model risk leader outlines how banks can recalibrate existing supervisory standards

Malkiel’s monkeys: a better benchmark for manager skill

A well-known experiment points to an alternative way to assess stock-picker performance, say iM Global Partner’s Luc Dumontier and Joan Serfaty

The state of IMA: great expectations meet reality

Latest trading book rules overhaul internal models approach, but most banks are opting out. Two risk experts explore why