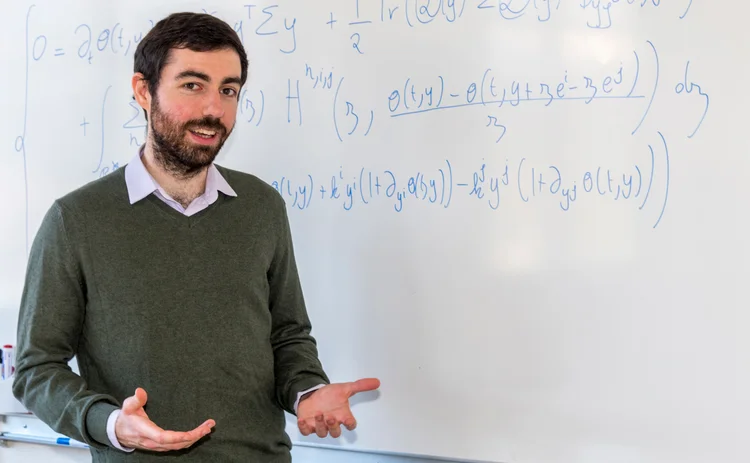

Rising star in quantitative finance: Philippe Bergault

Risk Awards 2024: A new market-making model provides FX dealers with a tool for managing inventory risk

Philippe Bergault’s work is as prolific as it is groundbreaking. His contributions to innovation in FX markets modelling – in themselves remarkable – are mirrored by his work in corporate bond and energy markets with a focus that blends mathematical rigour with real-world applications.

Assistant professor at Université Paris Dauphine-PSL, Bergault is collaborating with major banks. His research is already being deployed in HSBC’s foreign exchange business – one of the world’s largest – and has changed the way it trades.

“Philippe not only cares about the mathematics, he also really cares about the industrial and financial problems and talks a lot with practitioners,” says Olivier Guéant, professor of applied mathematics at Université Paris 1 Panthéon-Sorbonne, who is co-author of this research and was Bergault’s PhD supervisor. “He’s independent and very productive. During his PhD, he wrote six papers.”

“Philippe is from a younger generation and one of the best individuals I’ve met,” adds Alexander Barzykin, FX quant director at HSBC and co-author of the research. “There are very few people his age who are that good in the field.”

I love the theoretical part, but I need to keep in touch with real-world problems that will have some application that will be useful to practitioners

Philippe Bergault, Université Paris Dauphine-PSL

Guéant speaks proudly of Bergault, whom he helped shape as a young researcher and has continued to work with on numerous research projects. Together they produced a paper on dimensionality reduction techniques in over-the-counter markets, which considered requests for quotes (RFQs) of various sizes while existing literature only dealt with constant transaction size. Bergault says their model was tested on a major bank’s corporate bond data.

For his part, Bergault sought out Guéant for his reputation of applying theoretical frameworks to industry. “A lot of people are more interested in the theoretical side, especially in France, which is what made Olivier unique,” says Bergault. “I love the theoretical part, but I need to keep in touch with real-world problems that will have some application that will be useful to practitioners”.

Guéant and Barzykin connected at a market microstructure conference in 2019, while Bergault was completing his PhD. Barzykin sought to apply Bergault and Guéant’s framework to FX markets. The trio first published a paper on optimising risk controls for FX dealers using price ladders, tiers and hedging in single-pair currency markets.

The existing literature did not take into account the choice between internalisation and externalisation, an optimisation problem that boils down to the classic trade-off between hedging and incurring transaction costs or not hedging and being exposed to delta risk. The optimal control problem required to manage it is one Bergault had specialised in.

“Philippe was instrumental in the research and has shown a deep understanding of market microstructure and FX market-making,” says Barzykin.”The concepts are quite powerful by themselves and very practical. It’s about how you approach quantifying client flow, how you understand the client’s response to pricing and how you optimise both execution and pricing.”

The trio’s second paper, the winning paper for the award, applies this framework to multi-currency pairs, which exponentially increases the complexity of the problem they set out to solve. “It’s not something we created from scratch. It’s built on top of five other models we worked on in the past that we adapted to FX,” says Guéant.

Their work identified an inventory threshold below which a dealer is better off not hedging its FX exposure. As long as the inventory remains under the threshold, the dealer internalises its flow and adjusts its quotes on the dealer-to-client segment of the market. As soon as the inventory crosses the threshold, the dealer starts externalising in the dealer-to-dealer market to bring the inventory back to zero. “This effect was also shown in the first FX paper. The real novelty here was the multi-currency model and the quadratic approximation to solve it,” says Bergault.

His contribution to the research was extensive. He came up with the model alongside Guéant and focused mainly on the mathematics side of things, working on the code base of the main algorithm.

What is key is that these results found immediate interest at the trading desks aware of them – the concepts developed in both papers are being used at HSBC, says Barzykin.

Real-world nous

Throughout his career, the real-world anchor has been crucial for Bergault. Following his Masters’ in applied mathematics at Paris-Dauphine and Paris Didérot (now part of Paris Cité University), Bergault became a quantitative analyst intern in equity derivatives at Citi in London. But he wasn’t done with the theoretical side of applied mathematics and contacted Guéant to begin his PhD in applied mathematics at Paris 1 Panthéon-Sorbonne.

Bergault was drawn to OTC markets from the start. His knowledge of market microstructure and stochastic optimal control methods made him a key contributor in a paper that provides the mathematical framework for FX dealers to maximise their expected profit and control multi-currency inventory risk.

Throughout his PhD he worked on market-making and optimal execution models, so it was a natural fit for him to mix the two with the research he carried out with Guéant and Barzykin.

“The common point with everything we have been working on has been that it always relates to market microstructure or liquidity issues – how to make markets or how to model liquidity,” says Bergault.

During his post-doctoral year at the École Polytechnique, he worked on a problem related to energy markets with René Aïd from Paris-Dauphine and his supervisor Mathieu Rosenbaum, professor of quantitative finance.

This research dealt with a market demand issue, where two different market players are sharing the same order book. Aïd, Rosenbaum and Bergault looked at the optimal way to build incentives to provide liquidity in that market.

You need someone like Philippe who is super-strong mathematically, understands the microstructure of our markets, and who can also code up the model to evaluate the impact of the imbalance

Morten Andersen, JP Morgan

Bergault did the vast majority of the work, formalising the practical issue and coming out with a very impressive solution, finding a way to solve this really intricate mathematical problem. “He is really an academic financial engineer,” says Rosenbaum. “He is not only a great researcher, but… a great person to work with.”

Diversity and real-world problems have been a hallmark of Bergault’s career. In 2022, he and Guéant tackled liquidity modelling in corporate bond markets when Morten Andersen, senior quantitative analyst at JP Morgan, approached Guéant about the lack of theoretical framework for incorporating market imbalances into models for corporate bond quotes.

In standard approaches, liquidity is often assumed to be constant, explains Bergault, but “it’s not really true in practice because, of course, liquidity varies with time”.

“You need someone like Philippe who is super-strong mathematically, understands the microstructure of our markets, and who can also code up the model to evaluate the impact of the imbalance,” says Andersen.

He and others who have worked with Bergault highlight how involved and innovative he is as a researcher and commend his real-world ethos. They also remark on the impressive career he has already built at such a young age.

Bergault continues to teach various applied mathematics courses at Paris-Dauphine and is actively involved in further research with industry – his latest, with Guéant, delves into decentralised finance and the concept and design of automated market-makers. He says that for now he plans to stay in academia because he enjoys the freedom it gives him.

However, he adds: “I will never do only theoretical stuff.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Awards

Market data provider of the year: S&P Global Market Intelligence

S&P Global Market Intelligence has consistently met demands across Apac’s fast‑evolving capital markets, securing its win at the Risk Asia Awards 2025

Best user interface innovation: J.P. Morgan

J.P. Morgan wins Best user interface innovation thanks to its Beta One portfolio solution

Market liquidity risk product of the year: Bloomberg

Bringing clarity and defensibility to liquidity risk in a fragmented fixed income market

FRTB (SA) product of the year: Bloomberg

A globally consistent and reliable regulatory standardised approach for FRTB

Best use of cloud: ActiveViam

Redefining high-performance risk analytics in the cloud

Best use of machine learning/AI: ActiveViam

Bringing machine intelligence to real-time risk analytics

Collateral management and optimisation product of the year: CloudMargin

Delivering the modern blueprint for enterprise collateral resilience

Flow market-maker of the year: Citadel Securities

Risk Awards 2026: No financing; no long-dated swaps? “No distractions,” says Esposito