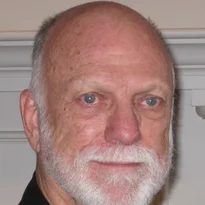

R. Douglas Martin

University of Washington

Professor Martin began his academic career in Electrical Engineering at the University of Washington and subsequently moved to the Statistics Department, where he was the second Chair of Statistics. In 2012 he moved to the Applied Mathematics Department to develop a new self-sustaining MS degree program in Computational Finance and Risk Management. A consultant in the Mathematics and Statistics Research Center at Bell Laboratories from 1973 to 1983, Martin later founded Statistical Sciences to commercialize the S language for data analysis and statistical modelling in the form of S-PLUS. Subsequently he was a co-founder and Chairman of FinAnalytica, Inc., developer of the Cognity portfolio construction and risk management system, serving as CEO from 2006 to 2008. Martin has authored numerous publications on time series and robust statistical methods, and is co-author of two books: Modern Portfolio Optimization (2005) and the second edition of Robust Statistics: Theory and Methods (2018). His research is on applications of modern statistical methods in finance and investment. He holds a Ph.D. in Electrical Engineering from Princeton University. Martin retired from the Applied Mathematics and Statistics Departments in June 2016, and remains active in basic research projects with students and PhD graduates in the finance industry, and is also active in mentoring Google Summer of Code projects focused on quantitative finance open source software.

Follow R. Douglas

Articles by R. Douglas Martin

Standard errors of risk and performance estimators for serially dependent returns

In this paper, a new method for computing the standard errors (SEs) of returns-based risk and performance estimators for serially dependent returns is developed.

Nonparametric versus parametric expected shortfall

In this paper, the authors use influence functions as a basic tool to study unconditional nonparametric and parametric expected shortfall (ES) estimators with regard to returns data influence, standard errors and coherence.

Inefficiency and bias of modified value-at-risk and expected shortfall

This paper compares mVaR and mES estimators with VaR and ES under normal and fat tailed t-distributions.

Better risk and performance estimates with factor-model Monte Carlo

This paper presents a solution to a common problem in asset and portfolio risk, when a manager has such a short history of asset returns that risk and performance measure estimates are unreliable.