Quant Finance Master’s Guide 2017

Welcome to Risk.net’s guide to the world’s leading quantitative finance master’s programmes

Click on universities in the table below for full course details. If the table is not displaying properly, click here for a pop-out version

Risk.net’s inaugural guide to the world’s leading quantitative finance master’s programmes is the first comprehensive work of its kind. It is aimed at students who want to become the quants of the future – as well as those who create the jobs they’ll end up doing.

The project also seeks to capture the changing nature of the quantitative finance industry, and the evolving skill set required to join it. On the sell side, the profession has fragmented almost beyond recognition, testing the definition of ‘quant’ for most banks; others now see the buy side as the place to be.

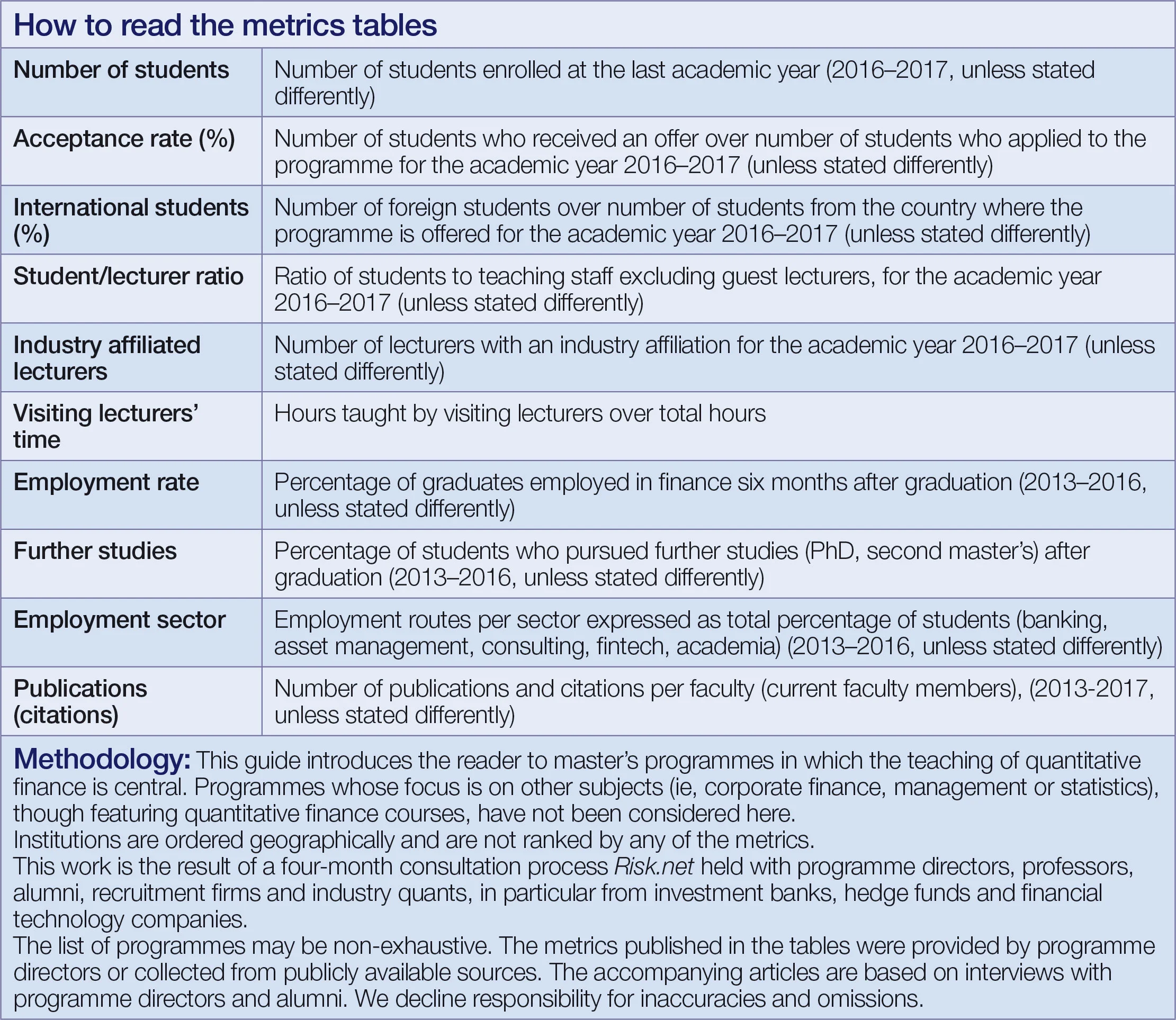

Our survey highlights common trends in the introduction of new courses, consistent with changing market requirements. But it also seeks to highlight how programmes develop their own distinctive features. As well as reporting metrics on students, their lecturers, and employability, we interviewed programme directors and alumni to provide the reader with comments and opinions that statistics alone could not communicate.

Collecting data has been facilitated by the helpfulness of faculty administrators and programme directors, for which we are grateful. In some cases, certain figures were not available, or those contacted – notably the London School of Economics, King's College London and the National University of Singapore – were unwilling or unable to provide metrics.

We initially sought to consider metrics on graduates’ salaries before and after completing a master’s, but ultimately decided not to due to the difficulty in verifying statistics and achieving a meaningful comparison between different countries and markets – and because some countries’ privacy laws impede their collection outright.

The guide is not intended to be read as a ranking of the various programmes on offer; Risk.net bears no responsibility for exceptions, oversights or omissions. The guide should not be relied on for advice – but at the very least, we hope it proves helpful to would-be master’s students, their teachers, and their future employers.

Research and reports: Sebastian Day and Alina Haritonova

Americas

Baruch College, City University of New York

University of California, Berkeley

Boston University

Carnegie Mellon University

University of Chicago

Columbia School of Engineering

Columbia University

Massachusetts Institute of Technology

NYU Courant Institute

NYU Tandon School of Engineering

Princeton University

Rutgers University

Stony Brook University

University of Washington

University of Toronto

University of Waterloo

IMPA

Europe

City, University of London

Imperial College London

Imperial College Business School

King’s College London

LSE

University of Oxford

University of Warwick

University of York

Bocconi University

University of Bologna

University of Florence

University of Turin

EISTI

Paris Diderot University

Pierre and Marie Curie University

University of Amsterdam

Erasmus University Rotterdam

EPFL

ETH Zurich/University of Zurich

WU (Vienna University of Economics and Business)

University of Leuven

University of Copenhagen

Technical University of Munich

Asia-Pacific

University of Sydney

Hong Kong University of Science and Technology

Maharishi University of Information Technology

National University of Singapore

This guide is the third part of a series on the future of quantitative finance, part of Risk’s 30th anniversary coverage. The first part, an opinion piece from UBS’s Gordon Lee, is available here. The second part, a feature on the changing role of the quant, is available here.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

CROs shoulder climate risk load, but bigger org picture is murky

Dedicated teams vary wildly in size, while ownership is shared among risk, sustainability and the business

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Climate Risk Benchmarking: explore the data

View interactive charts from Risk.net’s 43-bank study, covering climate governance, physical and transition risks, stress-testing, technology, and regulation

‘The models are not bloody wrong’: a storm in climate risk

Risk.net’s latest benchmarking exercise shows banks confronting decades-long exposures, while grappling with political headwinds, limited resources and data gaps

Cyber insurance premiums dropped unexpectedly in 2025

Competition among carriers drives down premiums, despite increasing frequency and severity of attacks

Op risk data: Kaiser will helm half-billion-dollar payout for faking illness

Also: Loan collusion clobbers South Korean banks; AML fails at Saxo Bank and Santander. Data by ORX News

Market doesn’t share FSB concerns over basis trade

Industry warns tougher haircut regulation could restrict market capacity as debt issuance rises

CGB repo clearing is coming to Hong Kong … but not yet

Market wants at least five years to build infrastructure before regulators consider mandate