This article was paid for by a contributing third party.More Information.

Navigating the volatility and complexity of commodity markets

Commodity markets have experienced significant challenges since the Covid-19 pandemic, the conflict in Ukraine and the subsequent sanctions imposed on Russia. These unprecedented events have caused fluctuations in supply and demand, disrupted global supply chains and triggered high volatility. Avadhut Naik, head of solutions at Quantifi, explores how firms are reassessing their risk management processes and systems to navigate a volatile and complex market

The challenges of today’s commodity markets

Commodity trading firms face several risks, which can be difficult to monitor and manage. Some risks – credit, operational, political, legal and reputational – are offset using insurance contracts. Others – such as market and liquidity risks – are actively hedged in the financial markets. Typically, firms actively monitor and reserve risk capital for risks that cannot be insured or hedged.

Clear risk management policies, implementation of best practices and systems that can measure, aggregate, monitor and manage risks are required for effective management of these risks. By the nature of their business, commodity trading firms face unique risk management challenges:

1. Global operations

Large commodity firms operate in several regional trading hubs across Europe, the Americas and Asia. These regions generally have their own – often multiple – systems for trading, operations and accounting. Managing data across these disparate systems to obtain a consolidated and consistent view of risk is a big challenge, made more difficult by regional time zones. A well-thought-out data architecture that includes rich extraction, transformation and loading capabilities for seamless integration with in-house data repositories and third-party sources is key to providing risk managers with a unified view of risk.

2. Physical and paper positions

Commodity firms typically hedge market risk on physical paper (financial) contracts executed on commodity exchanges or over-the-counter. Physical contracts have not undergone the same level of standardisation as in financial markets – their bespoke nature makes them difficult to value and risk manage. Risk management systems have typically focused on the financial markets. Systems that provide a more holistic approach to both physical and financial contracts are rare. Firms with access to these systems can gain a competitive advantage.

3. Lack of consistent practices across the industry

Over the years a consistent approach to valuation and risk management has evolved in the financial markets; the same level of consistent industry-wide approach is not found in the commodity markets. A consistent view of risk allows firms to size, compare and prioritise key risks while actively shaping their risk profiles.

4. Legacy risk management processes and systems

Most commodity trading firms use a variety of trading and accounting solutions that are augmented by spreadsheets and email-based processes for risk management purposes.

These traditional solutions are suitable for trading and operations. While they can also manage market, credit and liquidity risk, the necessary risk management components have not kept pace with industry best practice. Furthermore, the technology they are built on is often outdated.

Responding to risk

Market volatility has forced firms to rethink their risk management functions and those that proactively and effectively manage their risk will have an edge on competitors. With the right approach to risk management and by adopting best practices from financial firms, commodity firms would be better able to withstand market disruption.

Financial firms have traditionally been among the earliest adopters of risk management best practices. Banks are highly regulated – especially systemically important ones – and are required to implement prescribed risk management practices. The regulatory aftermath of the global financial crisis that began in 2007–08 resulted in further strengthening of these practices. Commodity firms can benefit by adopting the best practices applied in financial markets.

Data is crucial for commodity trading firms; however, from a data management perspective, commodities pose unique challenges. The leaders in commodities are those who can easily analyse and visualise data to make the best data-driven decision and manage the growth in data in the most efficient and flexible way. Business survival could depend on how well firms access and use data.

Integrated market and credit risk management

Firms should also consider integrating processes and systems under a common risk framework. Commodities market risk comprises flat price risk (exposure to commodity prices). Hedging physical commodity contracts with derivatives transforms flat price risk for basis risk (exposure on account of a mismatch between the physical commodity and hedging instrument). Typically, firms use value-at-risk (VAR) and scenario analysis as measures of exposure for monitoring and managing market risk.

Counterparty risk can be classified into two categories: open credit risk (counterparty defaults on payment obligations) and non-performance risk (failure of counterparty to buy or sell each contract). Counterparty risk is typically managed by screening counterparties by grading and assigning them credit limits and then managing open credit and non-performance exposures using these limits. Open credit exposures stem from accounts receivable, advances and prepayments. These exposures are easy to quantify and mostly insurable. On the other hand, non-performance risks are difficult to hedge and require probabilistic diffusion-based models. Potential future exposure (PFE) – a VAR-like measure – is typically used to model this risk.

VAR and PFE are both tail measures that are computed using some form of diffusion models. These can be closed-form (for example, parametric VAR/PFE) or simulation-based such as historical or Monte Carlo VAR. Historical and Monte Carlo based approaches, though better at capturing the dynamics of all risk factors involved, are data- and computationally intensive. Closed-form models, such as parametric VAR and PFE, are preferred where the data (for example, basis spreads) is difficult to source or calculation time is important, as in pre-deal checks.

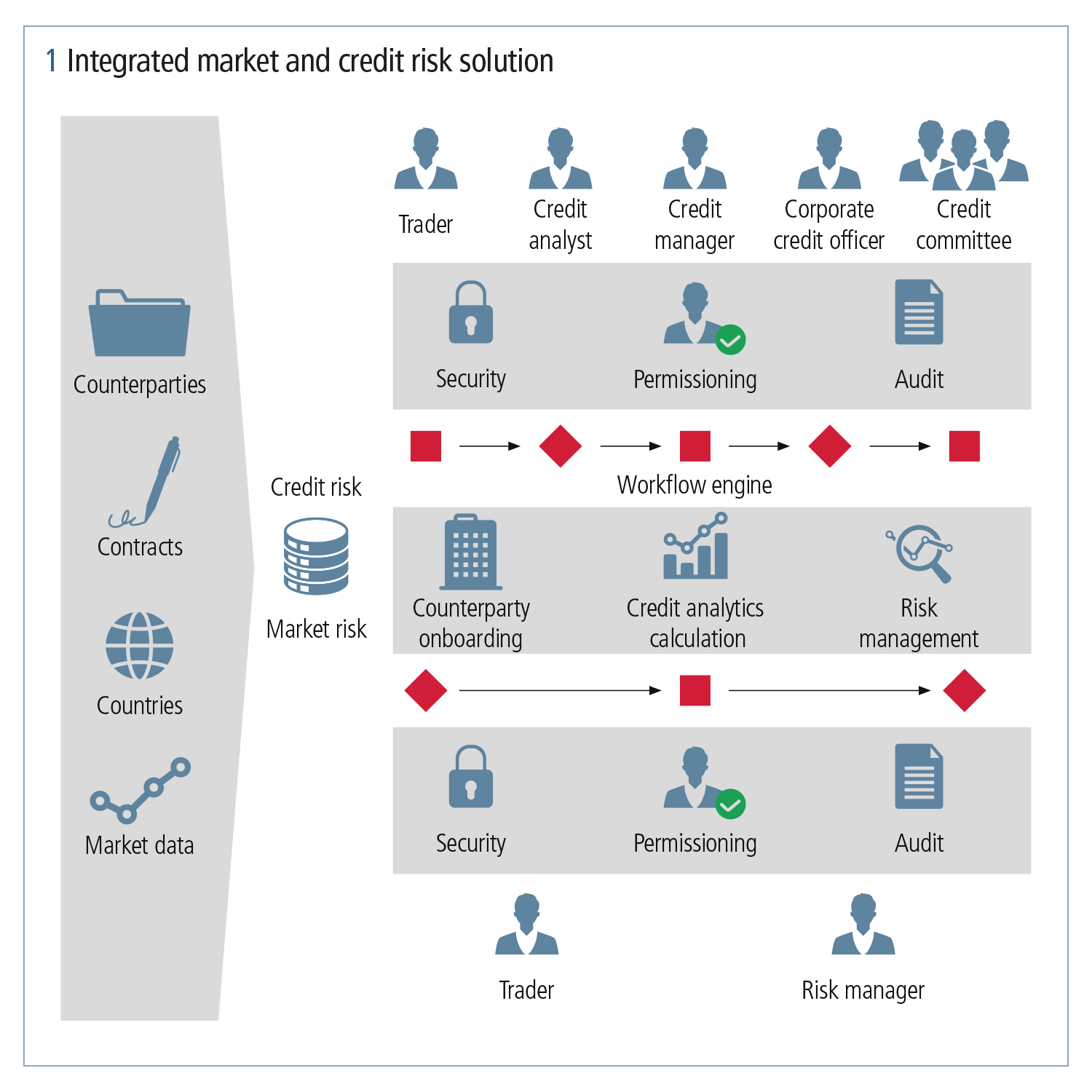

Similar datasets are required to calculate market and credit exposures. Additionally, a limits management framework and workflow engine is needed to mange both these risks. This level of overlap in data and infrastructure calls for an integrated solution, such as Quantifi, for market and credit risk management (see figure 1).

Disruptive technologies in commodity trading markets

Traditionally, commodity trading firms have been slow to adopt cutting-edge technology. Their risk management functions have relied on fragmented processes and tools such as spreadsheets and email to calculate exposures and implement workflows. Advances in database, cloud and messaging technologies can deliver integrated systems that consolidate and present a holistic view of risk. Data science technologies have also emerged that enable more detailed analysis of exposure and risk. Modern technology has become paramount in the execution of risk monitoring and oversight of commodity trading.

Reduce risk and complexity

With commodity trading firms exposed to increasing levels of risk, a focused and holistic approach to risk management is key to business success. Organisationally, this means having senior management commit to a risk management function that fosters a risk-aware culture across the enterprise. This requires having clearly defined risk policies – based on measurement, hedging and monitoring – that are consistently implemented using well‑defined processes and integrated systems.

Having in place a robust and user friendly solution such as Quantifi, which incorporates sophisticated risk measures and analytics, can help facilitate firm-wide adoption of effective risk management.

Quantifi’s commodity risk management solution is a high-performance, scalable and intuitive solution that can be seamlessly integrated into existing processes and systems. Available as on-premise or in-cloud, the solution is designed to help reduce risk and operational complexity with more accurate analytics, consolidated reporting and simplified data management. Automated processes reduce costs and allow firms to respond faster to market events to mitigate losses. Firm-wide, all participants involved in the market and credit risk management process can use Quantifi to make optimum decisions while managing the associated risk.

Learn more about Quantifi’s commodity risk management solutions

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net