This article was paid for by a contributing third party.More Information.

Companies delay climate policy action at their peril

Failure to take immediate action on the proposals set out in the Paris Agreement on climate change could cost approximately $1.2 trillion over the next 15 years in policy risk costs. Oliver Marchand, co-founder of Carbon Delta and executive director of MSCI, explores the potential impact of a delayed regulatory response to climate change on a number of sectors, and compares the risks of ‘dirty’ technologies – such as coal and oil – with the revenue opportunities of green technologies

Despite the ratification of the Paris Agreement on climate change in November 2016 – in which 185 nations committed to fight climate change and limit global warming – there remains a significant gap between implementation and the agreement’s envisioned goals. Consequently, the profiles of physical and transition risks are likely to become more complex and more severe than anticipated, potentially creating detrimental costs for companies in certain sectors.

Climate change is intensifying – as are countervailing attempts to work towards a low-carbon world – and was highlighted in the UN Environment Programme’s (UNEP’s) Emission gap report 2018. The report reiterated that achieving the Paris Agreement’s target of a 1.5° Celsius warming level would require unprecedented and urgent action by all nations.

To be more explicit on the ramifications of delayed action, pioneering analysis by Carbon Delta, which was acquired by MSCI in October 2019 and is a global leader in climate change scenario analysis,1,2 demonstrated that companies face potential losses of $1.2 trillion over the next 15 years if climate action is delayed.4 This analysis formed part of a wider landmark Changing course investor guide published by the UNEP Finance Initiative, which investigated methods for assessing climate risk while piloting the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD).4

Action must supplant aspirations

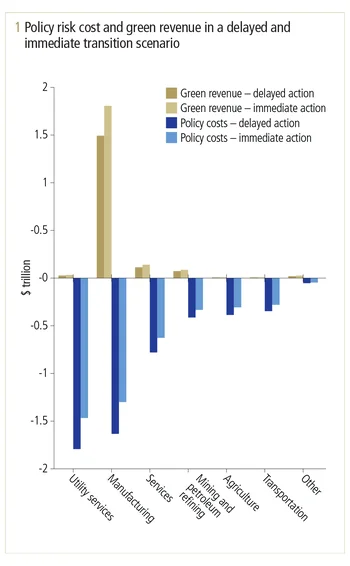

There is no denying that climate change risk has risen to the top of the corporate agenda, and is a high priority for investors as understanding of their respective exposures has grown. With financial institutions and companies beginning to implement scenario analysis and stress-testing methods, the potential monetary losses are being explored. However, there are even greater costs – to which funding has already been committed by national governments, depending on what each government can achieve with their own resources or with additional external funding – to delaying action. Not acting immediately on the Paris Agreement could potentially amount to the aforementioned figure of approximately $1.2 trillion over the next 15 years in policy risk costs, based on data from 30,000 companies studied by Carbon Delta. Further analysis of specific sector risk revealed an even wider gap in risk between sectors, with some sectors more acutely exposed than others (see figure 1).

Moving towards a 2°C world

The two scenarios used in MSCI’s analysis model a 2°C world, but adopt different transition pathways. The immediate action scenario is based on an integrated assessment model, the Regional Model of Investments and Development – known as Remind – and utilises a shared socioeconomic pathway (SSP) with a middle-of-the-road narrative (SSP2), whereas the delayed-action model was modelled using the Global Change Assessment Model (GCAM4) in combination with an ‘inequality’ narrative (SSP4). SSPs describe broad socioeconomic trends that could shape the future of society.5 The delayed action, modelled using GCAM4 SSP4, translates into a higher carbon price further into the future to meet the emissions reduction requirements in the 2°C global temperature goal, and thus a higher total reduction cost than an immediate action.

Sector comparisons reveal wide disparities

In MSCI’s analysis, sector exposures to transition risk in both immediate- and delayed-action scenarios are determined by attributing costs to different sectors. The manufacturing and utility sectors are most at risk, based on Carbon Delta’s sector classification system (see figure 1). Within the manufacturing sector, companies in the cement, and iron and steel segments faced the highest risk. They are closely followed by the chemicals sector, which MSCI also believes to have the highest technology remediation opportunities. For the utility sector, the conventionally emission-intense technologies coal and oil faced the highest risk in our analysis. Greener technologies, such as solar and wind, faced much less risk. Despite the risk in ‘dirtier’ technologies, there are potentially attractive green revenue opportunities if such companies chose to transition to more green technologies.

In both transition scenarios, the manufacturing and utility sectors are respectively responsible for 30% and 33% of the total policy cost. In terms of absolute costs, the potential difference between an immediate and a delayed scenario for both sectors was $300 billion. By contrast, although other less materially intense sectors such as services and transportation still faced a significant risk, it is notably less severe. In short, a delay in action is likely to compound the very high risks that materially intense sectors already face in immediate-action transition risk scenarios.

Not all doom and gloom

Despite the high policy costs in both the immediate and delayed policy scenarios, there are significant new investment opportunities to be explored. High costs to the manufacturing sectors are potentially offset by a very high-potential green revenue stream due to the large amount of low-carbon innovation taking place in such companies. These companies are investing in research and development to provide the technologies and services to enable the transition to a low-carbon world. Despite the technology opportunity across the sector, it is worth highlighting that some companies in the manufacturing sector will find it a challenge to transition due to a lack of concerted effort.

For policy-makers, the results suggest that transitioning to a more stringent policy pathway could also create low-carbon innovation and green revenues for sectors under stress. Manufacturing companies would encounter a less steep reduction curve and have more time to transform business models and develop clean technology, which could favour them rather than put them in the high-risk zone from climate policy.

Risks and opportunities for investors

MSCI’s analysis indicates both risks and opportunities for investors. As previously illustrated, a delayed regulatory environment could significantly increase the risks companies will face and may be detrimental to certain sectors of the economy more than others. Investors have an interest in understanding the risk and opportunity hotspots within their portfolios as well as a responsibility to apply forward-looking investment strategies to accelerate the transition to a low‑carbon economy.

Climate change has the potential to pose a systemic risk to the financial sector, while at the same time producing new investment opportunities. Managing these risks and capturing new opportunities can be crucial to protecting investment and optimising performance while meeting sustainability goals.

MSCI’s risk metrics indicate that investors who act fast will potentially be able to minimise risks and access high-growth companies, whereas investors who are slow to align their strategies with the fast-changing regulatory backdrop may face significant consequences. MSCI’s suite of climate change solutions provides a holistic toolkit to build more resilient portfolios.6 These are designed to assist institutional investors in prioritising their engagement strategies, allowing them to, for example, identify large reserve holders and emitters in their portfolios that also lack a strong carbon management strategy.

Focus on climate change

MSCI ESG Research has worked with institutional investors for more than 20 years to enable them to incorporate climate change considerations into their investment processes by providing an extensive climate risk assessment and reporting offering. This offering equips global investors with solutions to better understand the impact of climate change on their investment portfolios and comply with mandatory and voluntary climate risk disclosure initiatives and requirements. MSCI’s climate change solutions support investors seeking to achieve a range of objectives, including measuring and reporting on climate risk exposure, implementing low-carbon and fossil fuel-free strategies, and factoring climate change research into their risk management processes.

The acquisition of Carbon Delta expands MSCI’s robust suite of climate risk capabilities with state-of-the-art modelling technology that supports climate scenario analysis and forward-looking assessment of transition and physical risks, as well as extensive company-level analysis of publicly traded companies globally provided by MSCI ESG Research.

Notes

1. MSCI (September 2019), MSCI to strengthen climate risk capability with acquisition of Carbon Delta

2. MSCI (October 2019), MSCI completes acquisition of Carbon Delta

3. In April, Carbon Delta analysed costs for 30,000 publicly traded companies worldwide, analysing the potential costs and green revenues in each sector of the global economy in both delayed- and immediate-action transition scenarios.

4. To support the goals of the Paris Agreement on climate change, the Financial Stability Board created the TCFD in 2015. The voluntary disclosure platform was designed to “provide a framework for companies and other organisations to develop more effective climate-related financial disclosures through their existing reporting processes”, and support “more informed investment, credit [or lending] and insurance underwriting decisions”. In February 2019, the UN Principles of Responsible Investment (PRI) indicated its climate risk strategy and governance indicators, which align with the TCFD guidelines and will be mandatory for PRI signatories from 2020. Public disclosure will be voluntary.

5. Elsevier (January 2017), The SSPs and their energy, land use, and greenhouse gas emissions implications: An overview, Global Environmental Change, vol. 42, pp.153–168

6. MSCI’s climate change solutions offer evaluation of over 9,000 companies and 200 sovereign issuers, covering over 95% of equity and fixed income market value. All research is produced in-house, updated on an annual basis and submitted to companies for factual accuracy. MSCI climate metrics and carbon metrics are provided by MSCI ESG Research. MSCI ESG indexes and ESG analytics utilise information from, but are not provided by, MSCI ESG Research. MSCI equity indexes are products of MSCI and are administered by MSCI UK.

Climate risk – Special report 2019

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net