United Kingdom (UK)

FVC Custom Indexes

US and UK benchmark indexes declined sharply in June but recovered their losses in July, while the FVC’s global protected index recorded a rise in June

Global pension funds on the hunt for new custodians

Requests for proposals from continental Europe soar says JP Morgan pensions expert

Private placement structured products boosted by retail mandates

The use of structured products by discretionaries who are managing money on behalf of retail advisers has helped the private placement market continue growing.

The FSA's Retail Distribution Review: What price retail advice?

What price advice?

RBC Wealth Management creates new private client division in the UK

Philip Harris is to head the newly created Private Client Wealth Management team as RBC continues to build on its platform in the UK

Investec launches boutique subsidiary to target wealth managers

Investec unveils its first boutique products aimed at the wealth and discretionary management market

UK Treasury regulatory reform paper hints at potential industry costs

More details emerge on how the new regulatory regime in the UK will be structured

Barclays offers choice of barriers

Barrier picking

ETF issuers confirm tax status

ETF providers in the UK are busy confirming their distributor status, which will allow investors to pay capital gains rather than income tax

Lookback: The Which way

An irreverent take on events of the last month, including the Which confusion over structured products, ETF trading, S&P's benchmarks, a Swiss preference for capital protection and more capital gains tax in the UK

FVC custom indexes

The three FVC indexes fell between April and May 2010, mirroring the falls in the market’s benchmark indexes

Locking in principal protection

Merchant Capital is offering UK investors an at-risk growth product linked that locks in capital protection should the daily closing be at or above 110% of the initial level. Morgan Stanley is the issuer.

UK Wrap: Vanilla repeats rule the roost

Among the few products launched in the UK during the past two weeks, the popularity of the FTSE 100 is continuing as investors remain nervous

Incapital acquires Blue Sky Asset Management

US investment bank and structured products specialist Incapital will takeover UK distributor Blue Sky Asset Management. Blue Sky's book of plans will be subsumed into Incapital Europe

FTSE strengthens global business with executive hires

FTSE Group has added to its London office with the recruitment of five senior executives

Call for FSA to cut back on consultation documents

UK MP Jonathan Evans asks for a fresh, "simplified" approach on consultation, and fairer implementation of EU directives

UK ETF investors abandoning FTSE 100 in favour of global indexes

The balance of UK investments in ETFs has shifted from the FTSE 100 index towards ETFs based on the S&P 500, MSCI Emerging Markets and Japan in the first quarter of 2010.

FTSE indexes track firms' carbon exposure risk

Two new carbon indexes will enable investors to make investment decisions based on how carbon reduction schemes affect company earnings

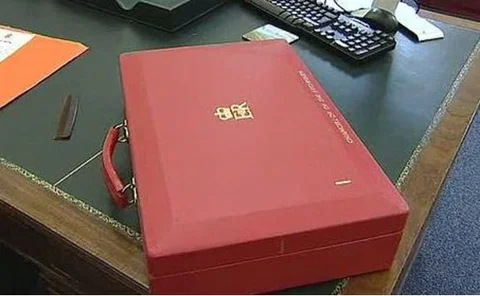

Capital gains tax reprieve cheers investors amid budget gloom

The less-than-expected increase in capital gains tax announced by UK chancellor George Osborne means structured products retain their tax-efficient status

Sovereign debt and CDSs: a collection of articles from Risk.net

The world is watching nervously as sovereign debt is rocked by fiscal and economic crises in the eurozone.

UK Wrap: Growth and income products proliferate despite rising volatility

Growth and income plans were by far the most popular style of product over the past three weeks, thereby disproving the previous UK wrap prediction that autocall products would increase in popularity

Market snapshot

Tim Mortimer of Future Value Consultants reviews the product preferences in the US and UK structured products markets