United Kingdom (UK)

Lord Turner: FSA break-up unnecessary

Financial Services Authority chairman Adair Turner supports Twin Peaks approach “in theory” but argues benefits could have been achieved without breaking up regulator

Regulatory reform may not be enough to prevent second crisis

A new study warns reform might only be enough to mitigate, not prevent, damage from a new crisis

FSA defends mobile-taping proposals, continues plans to enforce recording

UK regulator denies planned regulation is unenforceable or prohibitively expensive

ECB could offer governance concession on T2S

European Central Bank could modify governance arrangements of its settlement platform in a bid to entice sterling to join

Irish bailout fails to restore faith in PIIGS debt

CDS spreads on peripheral eurozone debt widen despite €90 billion in aid

Pensions In-Depth: Video interview with Geoffrey Staines

In an interview with GP's sister title Professional Pensions, Daily Mail & General Trust pensions director Geoffrey Staines talks to Jonathan Stapleton about communications, risk management and in-scheme resource.

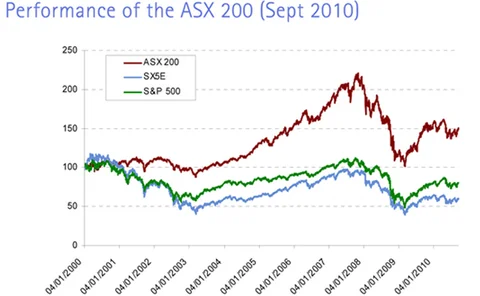

LM Investment offers access to the Australian economy

LM Investment offers access to the Australian economy

Lifemark investors low down in pecking order for payouts

Lifemark investors low down in pecking order for payouts

UK Wrap: Plan managers diversify away from FTSE

The products this fortnight offered an exciting variety of commodities, emerging markets, the Eurostoxx index, S&P index and the FTSE index

EU prepares to go the direct route on structured products law implementation

The introduction of several new European Union laws covering financial investments could prohibit sales of some products and push up costs

Lookback: Asia-Pacific drives wealth expansion

Lookback: Asia-Pacific drives wealth

Aviva Investors takes multi-asset approach to Europe

European ambitions

Best in the UK

Structured Products Europe Awards 2010

Market snapshot

Market snapshot

Correlation and kick-outs

Correlation and kick-outs

Market snapshot

Market snapshot

FSCS denies compensation on capital-at-risk Lehman products

The UK Financial Services Compensation Scheme has concluded that the marketing material for Lehman Brothers's capital-at-risk products was adequate and appropriate

UK businesses relieved over CRC’s dumping of carbon trade

Government plans to dump the cap-and-trade element of the UK Carbon Reduction Commitment (CRC) will ease risks for participating companies

Scor eyes UK pension funds’ longevity risk

Reinsurer Scor becomes the latest firm to enter the longevity arena

UK restructure could create scary superpower

UK restructure could create scary superpower

UK structured products stuck on repeat

An unfavourable pricing environment and investor caution is resulting in a series of familiar structures in the UK market. A few variations in underlying are evident but all come back to income

PPF offers potential £80 billion boost to longevity market

UK’s PPF is open to longevity derisking – at the right price

The UK revamp: What will get lost in the shuffle?

A new fraud-fighting body is being created as part of the UK government’s shake-up of financial regulation. Some welcome the proposed Economic Crime Agency, saying its integrated approach is just what is needed. Others worry valuable aspects of the old…

Market snapshot

The sale of structured products in the US has increased by around 36% in June and July. In the UK, the market in the same two months was characterised by the continuing dominance of capital-at-risk products.